Financial Capital Strategy

Maximize GVA and Equity Spread through Cost of Capital-Oriented Cash Allocation

The financial strategic issue of the Medium-term Management Plan VISION 2030 stage1 is to improve Gunze Value Added (GVA) by balancing investment in growth businesses

and sustainable areas like the environment investments with capital cost reduction, while maintaining a strong financial base. We are strengthening profitability

management in terms of invested capital while working to restructure low-margin operations and downsize assets.

Since last year, there has been strong demand for accountability regarding management focused on the cost of capital and stock price. We will formulate financial

strategies looking beyond VISION 2030 stage2 by further refining the aforementioned initiatives.

Results Evaluation

On a consolidated basis, Gunze reported net sales of ¥132.8 billion, down 2.7% compared with the previous fiscal year and 5.1% below forecasts. From a profit

perspective, operating profit came in at ¥6.7 billion. Despite a ¥0.9 billion increase compared with the previous fiscal year, this was ¥0.7 billion lower than

forecasts. Ordinary profit totaled ¥6.7 billion, up ¥0.7 billion year on year but ¥0.7 billion below forecasts. Net profit was ¥5.1 billion, up ¥0.6 billion year on

year and ¥0.3 billion compared with forecasts. While falling below forecasts with the exception of net income, each profit accounting line item increased year on year

despite lower revenue.

The decrease in net sales year on year was largely due to a drop off in sales from the development of the former factory site in the life creations business in the

previous fiscal year. Overall, materials-related businesses were affected by customers inventory adjustments and reduced use of plastics, while apparel-related

businesses suffered in terms of volume due to consumer spending restraints and unfavorable weather.

Operating income was negatively impacted by lower volumes, high raw material prices in materials operations and the yen’s depreciation in the apparel business. However,

this was offset by price increases and cost reductions.

By segment, the functional solutions business posted operating profit ¥6.0 billion (down ¥0.8 billion from the previous fiscal year) due to a sharp decline in demand

especially in the plastic films field, while the apparel business turned profitable at ¥1.4 billion (a ¥1.6 billion improvement from the previous fiscal year), after

posting a loss of ¥0.2 billion a year earlier, due to product price increases and pro- duction restructuring. In the medical business, profits fell slightly despite

sales growth because of higher costs from investing in human capital to expand operations.

As part of our business restructuring activities, in the electronic components field, following the transfer of the film business in the previous fiscal year, we

concluded a share transfer agreement for our Chinese manufacturing subsidiary in the touch panel business and decided to withdraw from the business by the end of

September 2024, including commercial rights in Japan and the United States. In addition, the Company recorded a total of ¥2.8 billion in extraordinary losses, which

include the closure of an Indonesian socks manufacturing subsidiary and the decision to close and streamline unprofitable sports club outlets. Elsewhere, the impact on

net income was minimal due to capital gains of ¥2.0 billion from reductions in cross-shareholdings and a tax benefit of ¥2.5 billion on the impair- ment of investments

in subsidiaries.

FY2024 Forecasts

The outlook remains uncertain due to rising prices driven by high raw materials and fuel prices, the impact of the yen’s depreciation, and concerns about overseas

economic slowdowns. Taking these business risks into account, we have proactively factored into our 2024 earnings forecasts the recovery of materials-related markets,

efforts to improve productivity through automation and DX, strengthening of cost competitiveness through a globally optimized production system, expanding of our raw

materials procurement network and reductions of costs, increases in sales through new value creation activities that identify various changes in the market, and the

boost from business structure improvements implemented up to the previous fiscal year.

In the functional solutions business, we target increases in sales of 1.5% year on year and profits of just under ¥1.2 billion, taking into account the active launch of

new environmentally friendly products in the plastic films field and the full-scale operation of our Circular Factory™ (resource recycling facility), as well as an

expansion in the share of products for the OA market in the engineering plastics field, increased demand in the medical and semiconductor fields, and the impact of our

withdrawal from the electronic components field. In the medical business, we target a 11.1% increase in sales and a little over ¥500 million increase in profits,

factoring in higher sales of existing products due to plant expansion, increased demand for adhesion barriers, and growth in China and the United States. In the apparel

business, we target increases in sales of 8.5% and profits of more than ¥400 million, despite the expected weak yen, by expanding D2C routes and increasing sales of

ladies’ innerwear through differentiated new products, and lower costs by establishing a globally optimized production system. In the lifestyle creations business, we

target a slight increase in revenue of 0.6% and a rise of slightly less than ¥300 million in income based on the expected rise in profitability of commercial

facilities, benefits from structural improvements in the sports club field, and expansion of mainly school operations.

In overall terms, net sales are forecast to total ¥140 billion (up 5.4% compared with the previous fiscal year), operating income ¥9 billion (an increase of slightly

more than ¥2.2 billion year on year), and net income ¥7.5 billion (an increase of slightly less than ¥2.4 billion year on year).

Financial Strategies and Key FY2023 Initiatives under VISION 2030 stage1

In FY2023, fund procurement in U.S. dollars was restructured to control the cost of debt. The Gunze Group used a Hong Kong-based controlling company with low

procurement costs to raise U.S. dollar-denominated funds in lump sums and manage them. However, financing costs, which had not changed significantly for a long time,

began to rise in February 2022, and by the end of FY2022 were approximately nine times higher than before. After considering the future direction of the Company, we

decided to liquidate the controlling company and transfer the control functions for fund procurement in U.S. dollars to the Japan head office in February 2023 based on

the main business of the controlling company having met certain goals.

Upon the transfer, we decided that part of the Company would be funded directly from outside sources taking into consideration foreign currency regulations and transfer

pricing taxation in each country. In addition, capital increases were carried out for part of the Company to optimize its capital structure. The capital increase was

funded by cash generated from the sale of cross-shareholdings and cash position revamps, so the capital increase did not result in any increases in interest-bearing

debt or debt costs. As a result, the Group’s cost of debt for FY2023 was 1.70% (a decrease of 0.14 percentage points from the previous year).

In FY2024, overseas procurement costs remain high, while domestic procurement costs are rising due to changes in the Bank of Japan’s monetary policy. We will continue

our Group-wide efforts to control debt costs.

GVA* / ROIC

*GVA (Gunze Value Added): Gunze’s original indicator

GVA for FY2023 came to a loss of ¥1.6 billion (improvement of ¥0.8 billion year on year and ¥0.5 billion below forecasts).

While operating income was as mentioned above, invested capital was ¥129.4 billion (down ¥3.7 billion year on year and ¥0.3 billion above forecasts), mainly due to the

sale of cross-shareholdings and despite foreign assets increasing more than expected mainly due to foreign exchange effects.

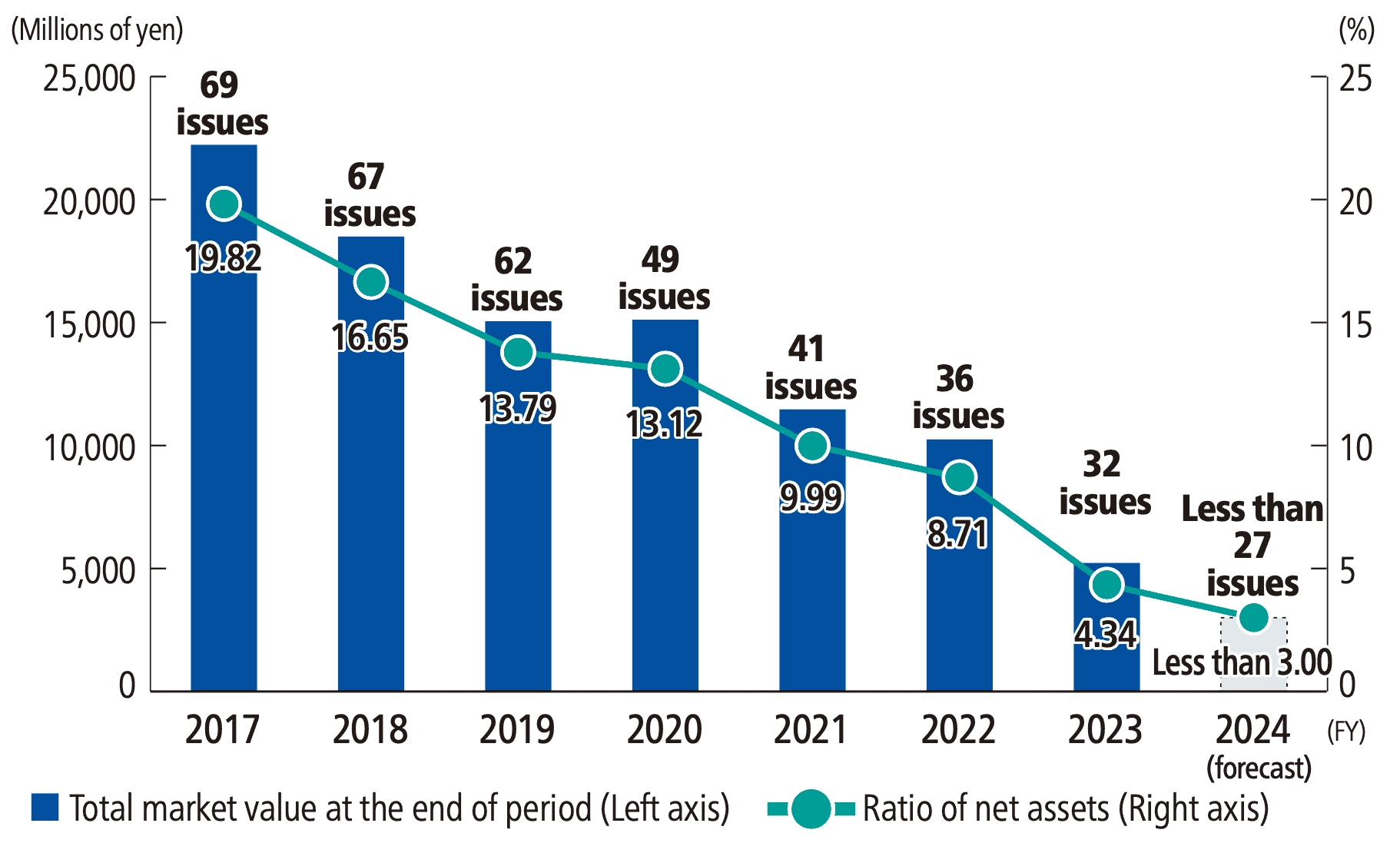

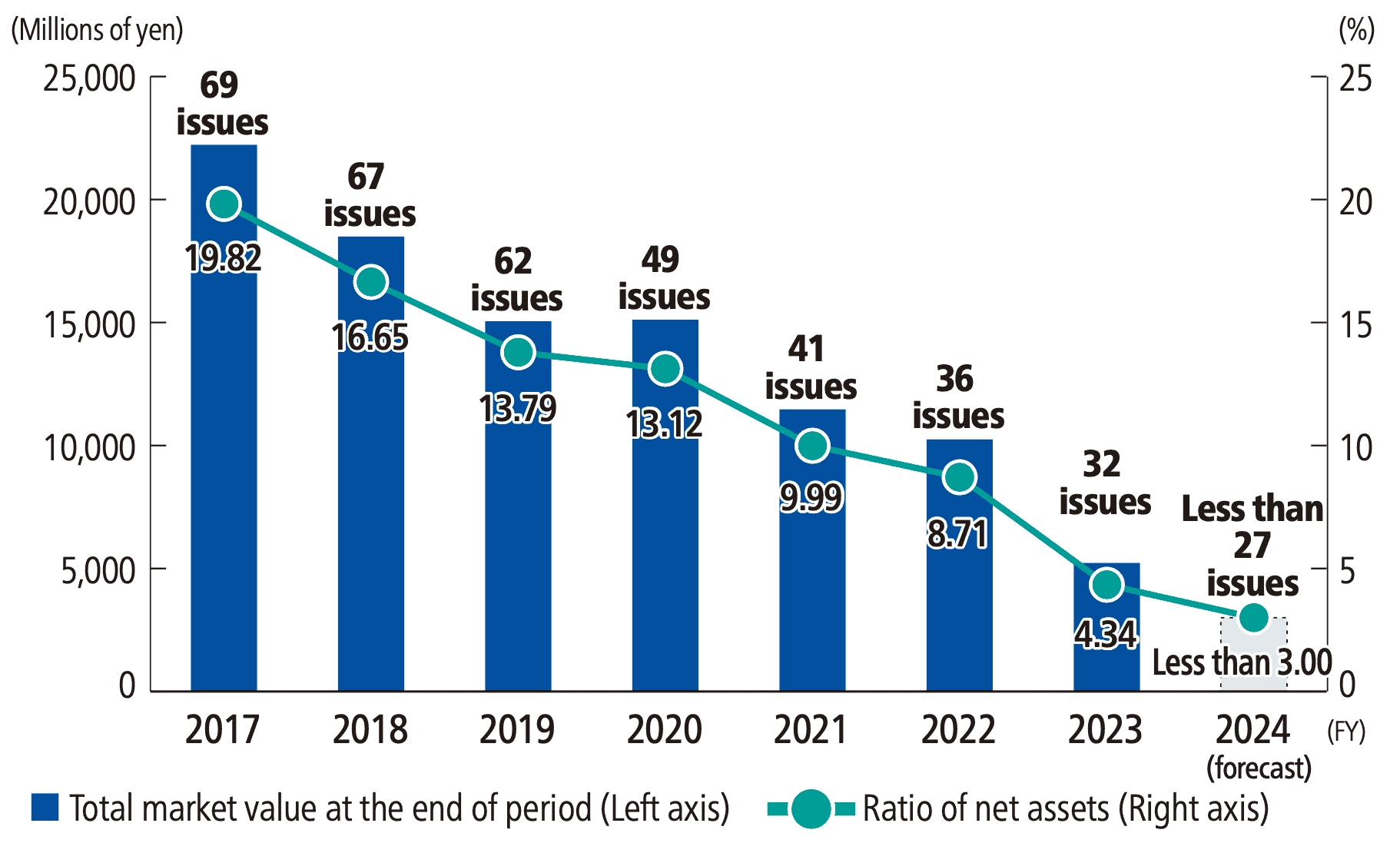

The reduction of cross-shareholdings proceeded smoothly in FY2023. At the end of FY2023, we held 32 stocks, representing 4.34% of net assets. In FY2024, we plan to

reduce our holdings to 27 stocks or less, representing less than 3% of net assets. The cash generated from the sale will be used for investment in plant expansion to

increase production in the engineering plastics field and medical business.

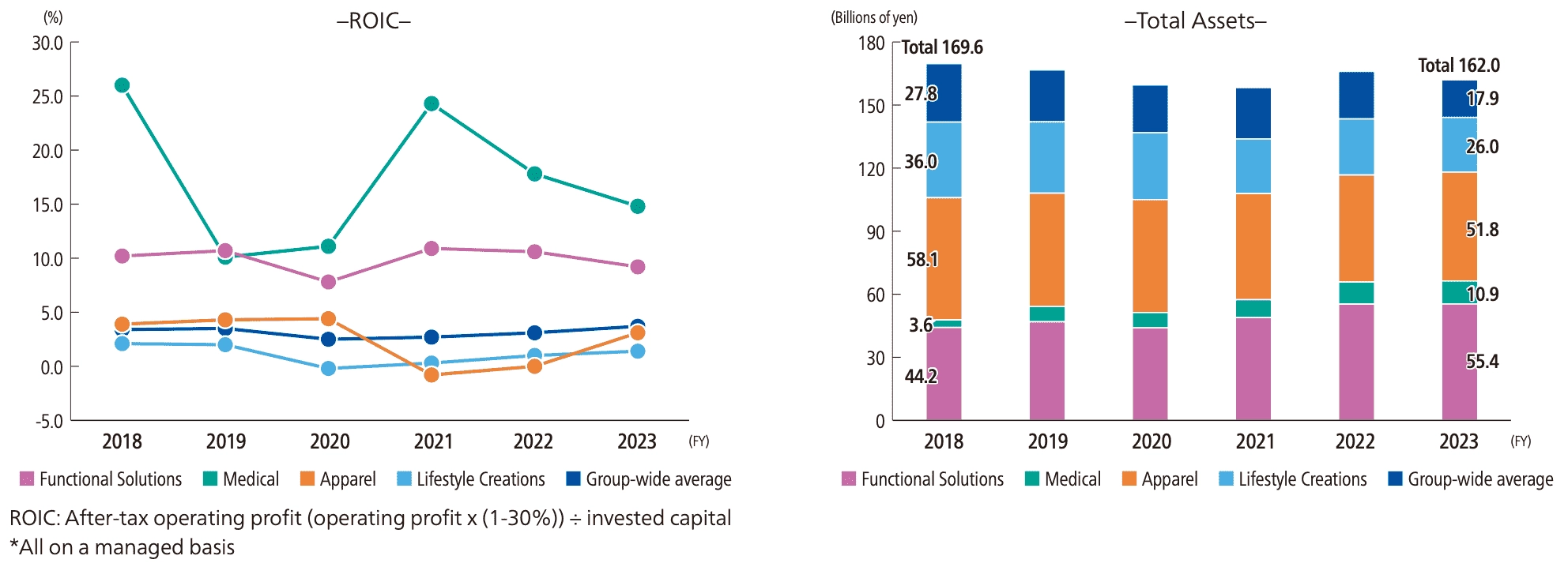

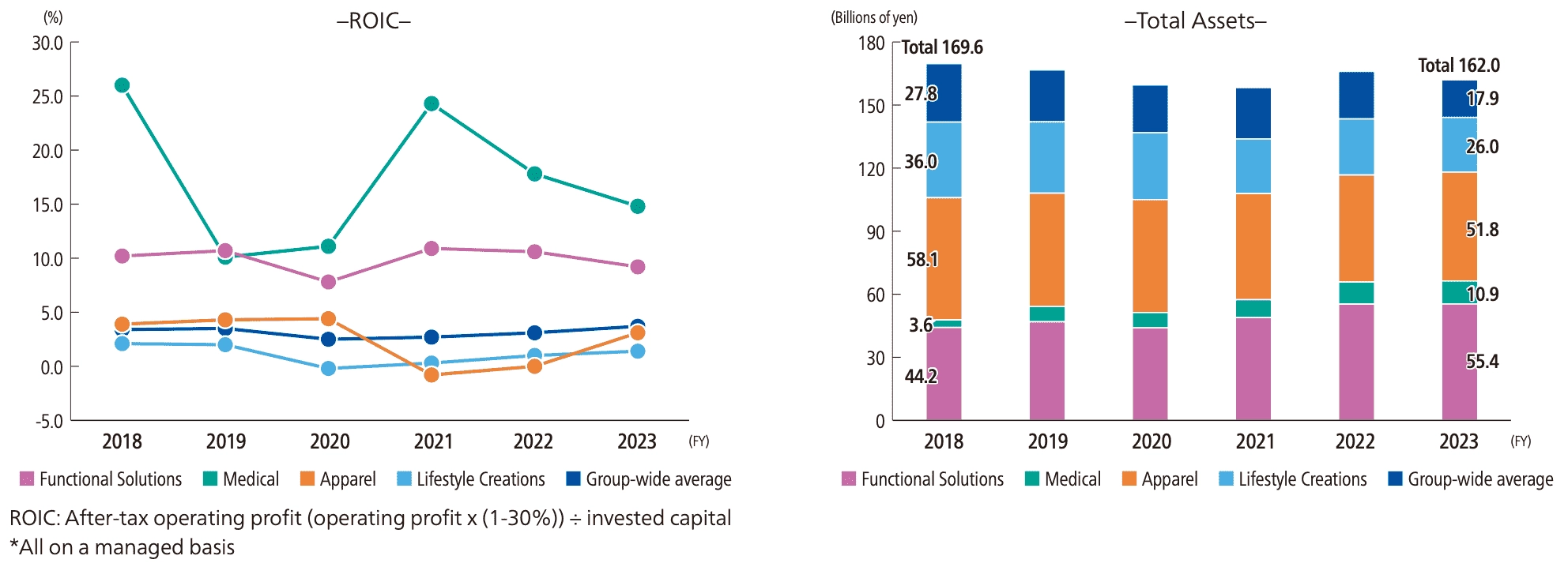

Next, we look at conditions by segment. The Gunze Group began cost of capital-based management in FY2019 and has been working to increase Group returns on capital,

resulting in changes in the composition of the Group’s total assets and returns on capital of each segment.

Looking first at total assets, we have been working to reduce cross-shareholdings and low-profit assets, while simultaneously investing heavily in the functional

solutions and medical businesses, both of which have been positioned as growth businesses. As a result, total Group assets were reduced by ¥7.6 billion to ¥162 billion

compared to the period immediately prior to the start of capital-based management (end-FY 2018). The share of functional solutions and medical businesses in total

assets increased from 28% to 41%. The total assets of the medical business, which has particularly high growth potential, have increased around threefold.

Turning next to ROIC, the latest ROIC for the functional solutions business has fallen to the 9% range due to sluggish sales in the plastic films field and the impact

of investment in the Circular Factory™, but we expect it to recover to the 10% range in FY2024. Although ROIC is declining in the medical business due to investments in

human capital and equipment, we consider the current level to be within an acceptable range, as a temporary dip during the growth process. ROIC deteriorated in the

apparel and life creations businesses due to the pandemic depressing profits, but restructuring has improved profitability, and we expect ROIC to recover to

pre-COVID-19 levels in FY2024.

Currently, the main issue is to return the apparel and life creations businesses to GVA profitability. We believe that the apparel business can return to GVA

profitability if restructuring is pursued further and the currently abnormally weak yen corrects to an appropriate level. On the other hand, in the lifestyle creations

business, we believe it is necessary to go one step further to improve profitability, not only by closing unprofitable outlets in the sports club field, which we are

currently working on, but also by restructuring the real estate field, where we have a large capital investment.

Another issue is the lack of improvement of the Cash Conversion Cycle (CCC), which has been deteriorating since the pandemic. In particular, we will strengthen measures

for inventory turnover, including GVA positive divisions (= ROIC management division). For GVA positive divisions, the focus will be on maintaining and improving ROIC

based on peer group standards.

Internal management indicators are linked to individual operations through development of the ROIC tree in an effort to raise member awareness of capital profitability.

Promotion of the reduction of cross-shareholdings

ROIC and Total Assets

GVA / ROE Results and Forecasts

(Unit: Billions of yen)

|

FY2018

(fiscal year ended March 2019) |

FY2019

(fiscal year ended March 2020) |

FY2020

(fiscal year ended March 2021) |

FY2021

(fiscal year ended March 2022) |

FY2022

(fiscal year ended March 2023) |

FY2023

(fiscal year ended March 2024) |

FY2024 Target

(fiscal year ending March 2025) |

| Operating profit |

6.6 |

6.7 |

4.6 |

4.8 |

5.8 |

6.7 |

9.0 |

| Invested Capital |

137.3 |

134.2 |

132.7 |

125.8 |

133.1 |

129.4 |

131.0 |

| GVA※ |

-1.9 |

-1.6 |

-3.1 |

-2.6 |

-2.3 |

-1.6 |

Companywide return to profitability |

| ROE |

3.7% |

4.0% |

1.9% |

2.6% |

3.9% |

4.4% |

6.32% or

higher

|

-

Gunze Value Added (GVA) = (NOPAT + dividends) - (period-end invested capital (total assets - non-interest-bearing debt)) x WACC

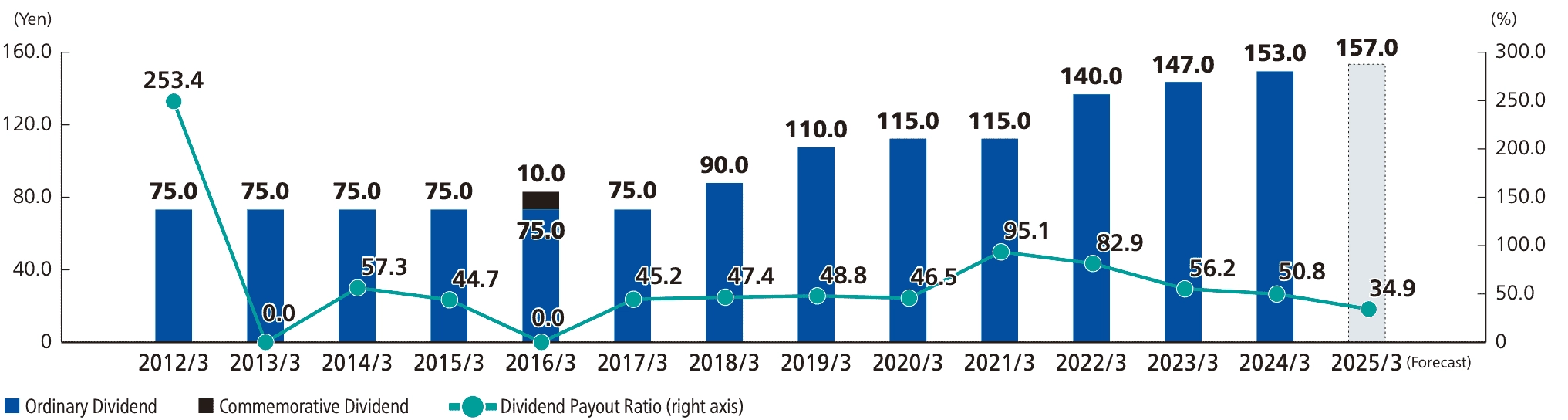

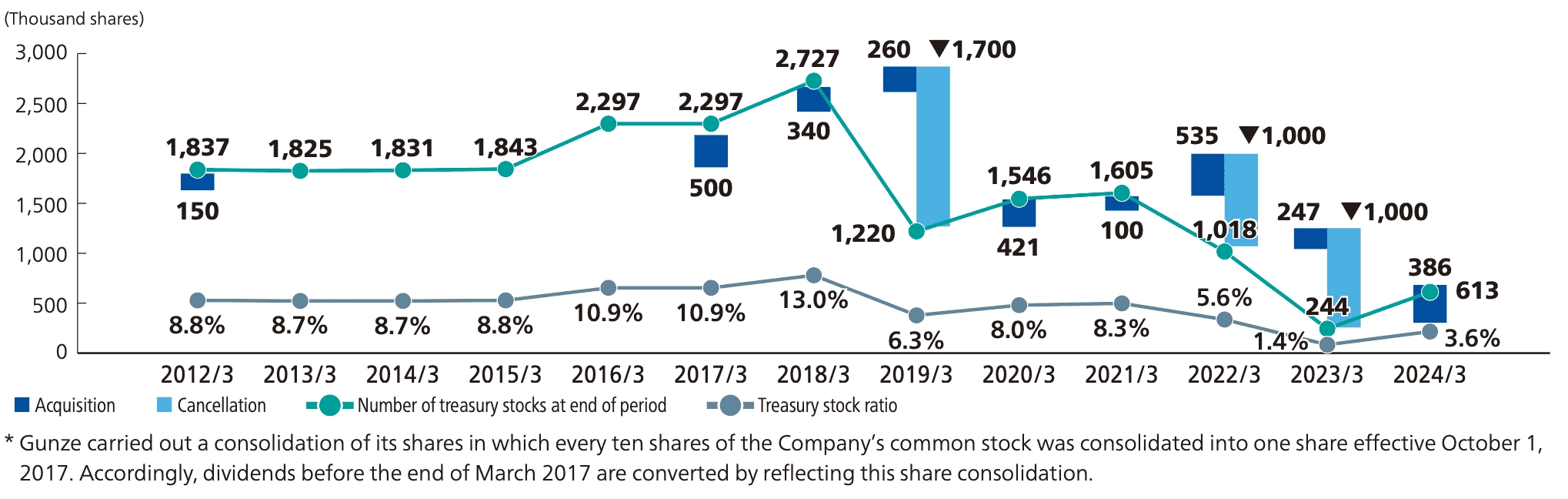

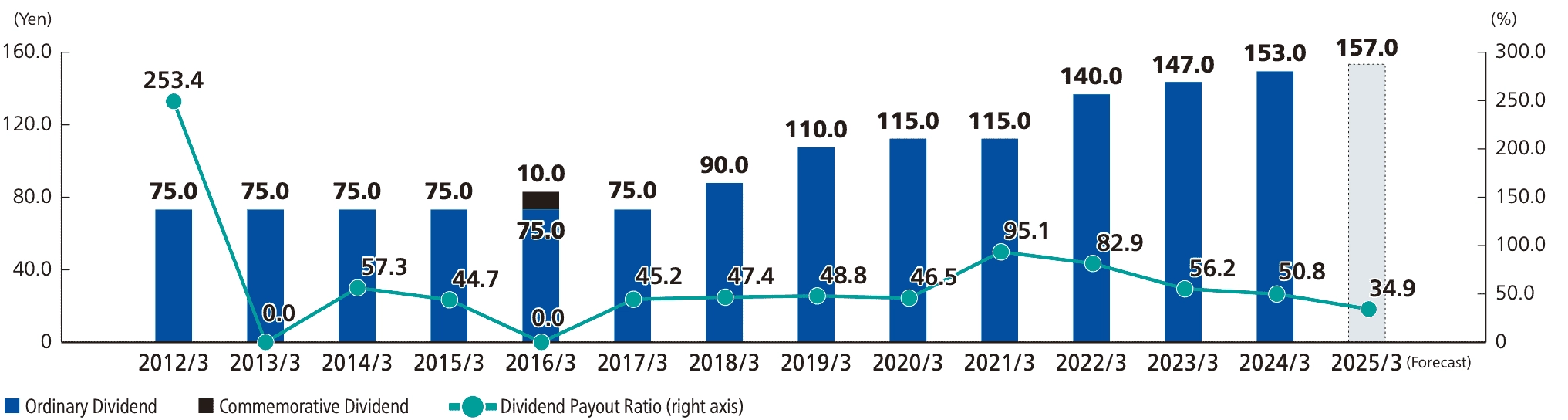

Pursuing an Optimal Shareholder Return Strategy Focused on Capital Costs

The Gunze Group positions the return of profits to shareholders as an important management policy and, in VISION 2030 stage1, aims to maintain a total return ratio of

100% until ROE exceeds the cost of shareholders’ equity. This is because our policy is to improve the return on capital by increasing earnings, and we have determined

that in order to maintain and improve our financial soundness, we do not need to hold more shareholders’ equity than we currently do. Consequently, even after achieving

an ROE that exceeds the cost of shareholders’ equity, we may be able to continue returning profits at current levels as part of our capital policy.

The primary method of returning profits to shareholders will be stable and continuous dividends based on DOE, with the remainder being returned through share buybacks.

The standard DOE is set at the lower limit of 2.2%, the median of the profit return of companies listed on the First Section of the Tokyo Stock Exchange at the time of

its establishment (according to a securities company survey), but we believe that the dividend payout ratio level needs to be reviewed to reflect future profit growth.

In light of the risk that excessive share buybacks may increase the cost of shareholders’ equity due to reduced liquidity of shares, we will consider the optimal

balance between dividends and share buybacks, taking into account the Gunze Group’s financial position and shareholder composition, revising the policy as necessary.

Dividend per Share, Dividend Payout Ratio

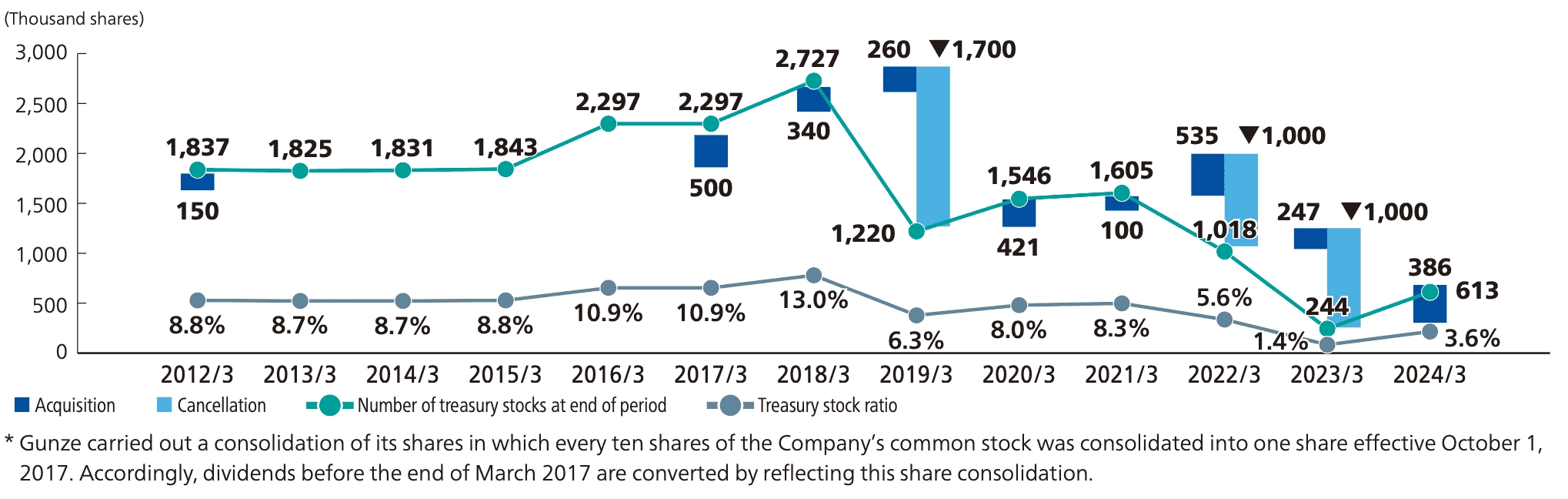

Treasury Stock

Next Medium-term Management Plan and Equity Spread Maximization

Gunze Group PBR at the end of FY2023 was 0.8x, continuing to impair corporate value. While there are many factors behind this low PBR, we believe the main factor is a

negative equity spread, in other words ROE being less than the cost of shareholders’ equity. Under VISION 2030 stage1, the cost of shareholders’ equity has been set at

6.32%.

However, we believe that an ROE of at least 8% is necessary to create an equity spread that will satisfy shareholders based on our most recent estimates, which take

into account dialogue with investors and the state of interest rates in Japan and overseas. If we aim for an ROE of 8%, we would need to increase profits by more than

1.3 times compared with our profit forecasts for FY2024. To that end, we will make aggressive investments to achieve early business growth. Considering factors such as

the cost of capital and the most recent level of the net debt-to-equity ratio, we believe that investment should be financed with debt. With financing costs rising both

domestically and overseas, however, we believe it is necessary to be more selective in our investments than before and to carefully examine the amount and duration of

fund-raising based on the impact on ROE.

Based on the recent rise in interest rates, we plan to review our debt costs, shareholder’s equity costs, and WACC in our next medium-term management plan. We will

strive to maximize GVA and equity spreads by pursuing an optimal capital structure and cash allocation in terms of profit levels, financial soundness, and capital

efficiency.

Internal Corporate Communications Efforts to Instill GreaterAwareness Toward Cost of Capital-based Management

Booklet published to instill greater awareness toward cost of capital-based management

Booklet published to instill greater awareness toward cost of capital-based management

In order for employees to better understand the concept and details of the Group’s cost of capital-based management, we have taken steps to explain

and promote the importance ofGVA, a management indicator, a total of 10 times using the intranet and internal newsletters since fiscal 2020. In

doing so, we have worked to instill greater awareness toward cost of capital-based management and to unify all employees behind the Group’s

endeavors.

Furthermore, we took steps to issue a series of easy-to-understand booklets to help employees better comprehend the connection between daily

operations and cost of capital-based management and the individual tasks to be undertaken to improve GVA. This initiative was made in response to

calls to document the Group’s management policies in paper form. After completing this series, we conducted a survey and posted feedback, including

details of the level of understanding, on the intranet. We will continue to make cost of capital-based management more familiar to employees. By

deepening their understanding, we would expect employees will increasingly put cost of capital-based management into practice in their work.