| Initiative Details | |

|---|---|

| Fiscal 2005 | Introduced a corporate officer system and reduced the number of Directors |

| Fiscal 2006 | Reduced the term of office for Directors from two years to one year |

| Began appointing outside Directors and female Directors | |

| Fiscal 2015 | Formulated the Gunze Corporate Governance Guidelines |

| Fiscal 2018 | Moved to a structure with two female Directors |

| Fiscal 2019 | Established the Nomination/Remuneration Committee (chaired by an outside Director as an advisory committee to the Board of Directors) |

| Ratio of outside Directors exceeds one-third of the Board | |

| Fiscal 2021 | Published the skill matrix for Directors and Corporate Auditors |

Corporate Governance

- Basic Policy for Corporate Governance

- Initiatives to Enhance Corporate Governance

- Corporate Governance Structure

- Director and Corporate Auditor Appointments

- Assessment of Board of Directors’ Effectiveness

- Board of Directors’ Deliberations

- Main Activities of Corporate Auditors

- Director and Corporate Auditor Training

- Succession Plan

- Executive Remuneration System

- Promoting Compliance

- Strengthening the Risk Management System

- Gunze Corporate Governance Guidelines

Basic Policy for Corporate GovernanceThe Gunze Group recognizes that legal and regulatory compliance is essential for meeting our basic management policy of sustainably boosting corporate value.Accordingly, we strive for swift decision-making and timely and appropriate disclosure of corporate information so that we can respond appropriately to the social and economic environment. We therefore consider improving shareholder value, by enhancing the transparency of our management, to be one of our most important management objectives. To achieve this, the Gunze Group seeks to build sound relationships with our multiple stakeholders and strengthen and upgrade our internal control functions as a way to enhance our corporate governance.

Initiatives to Enhance Corporate Governance To accelerate business decisions and to strengthen the management supervision function, the Gunze Group intro- duced a corporate officer system and reduced the number of Directors in FY2005. Having clarified the management responsibilities of Directors, we revised their term of office in 2006 from two years to one year with the goal of estab- lishing a management framework that can respond more quickly to changes in the business environment. At the same time, we began appointing outside Directors in an effort to ensure the transparency of management. In addi- tion, we have striven to enhance our corporate governance by having the Board of Directors make a final decision on nominating candidates for Director positions following History of Governance Enhancements deliberations by the Nomination/Remuneration Committee. The Nomination/Remuneration Committee was established in FY2019 as an advisory committee to the Board of Directors, comprises the Representative Directors and outside Directors, and is chaired by an outside Director. Moreover, in 2015 we formulated the Gunze Corporate Governance Guidelines as the basic policy for corporate governance by the Gunze Group. We revised these Guidelines in 2021.

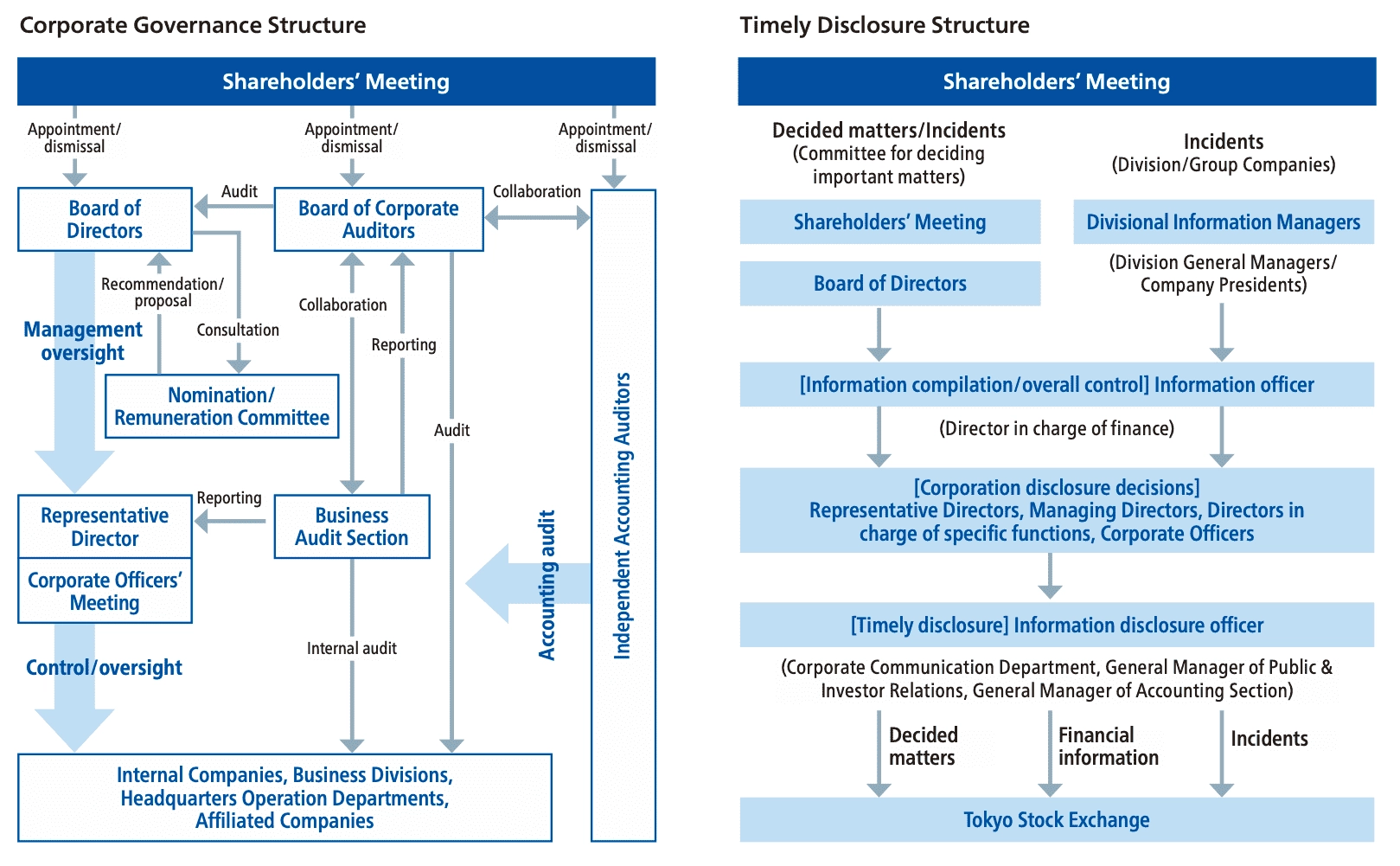

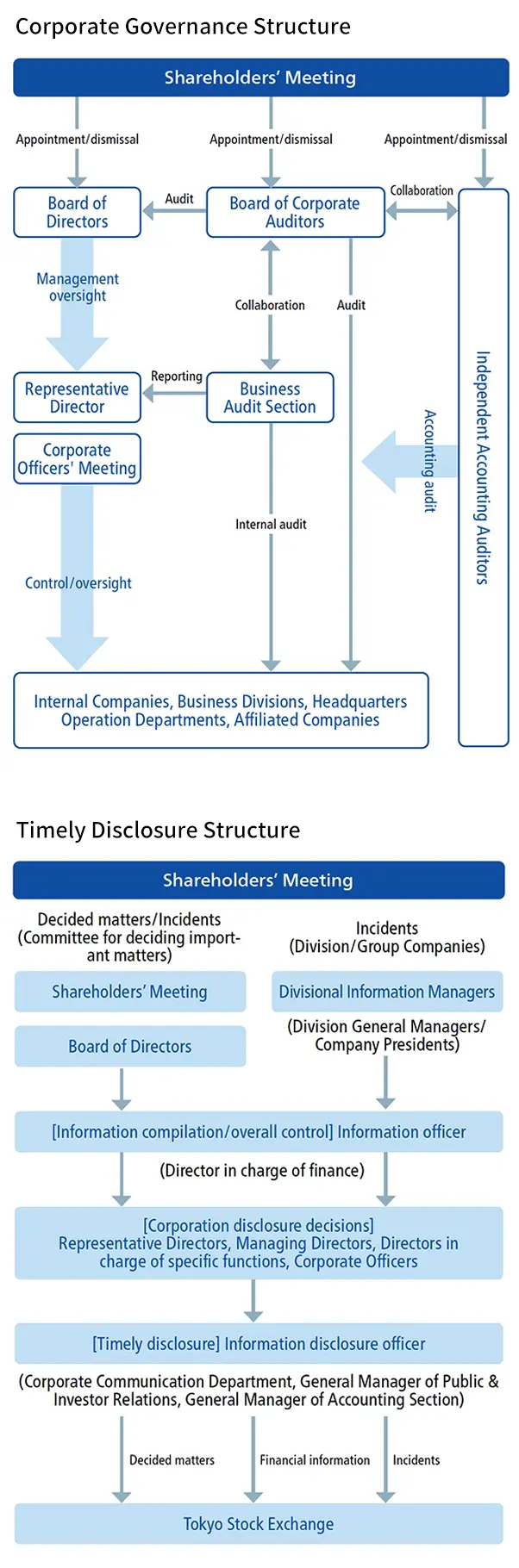

Corporate Governance Structure

The Gunze Group is a company with a Board of Corporate Auditors, where the Board of Corporate Auditors comprises four Corporate Auditors, two of whom are outside

Corporate Auditors (as of June 25, 2024). The Corporate Auditors attend the Board of Directors and other important meetings, conduct onsite audits of business and

management divisions, and inspect domestic and overseas subsidiaries, while performing other duties, in order to fulfill their management supervisory function.

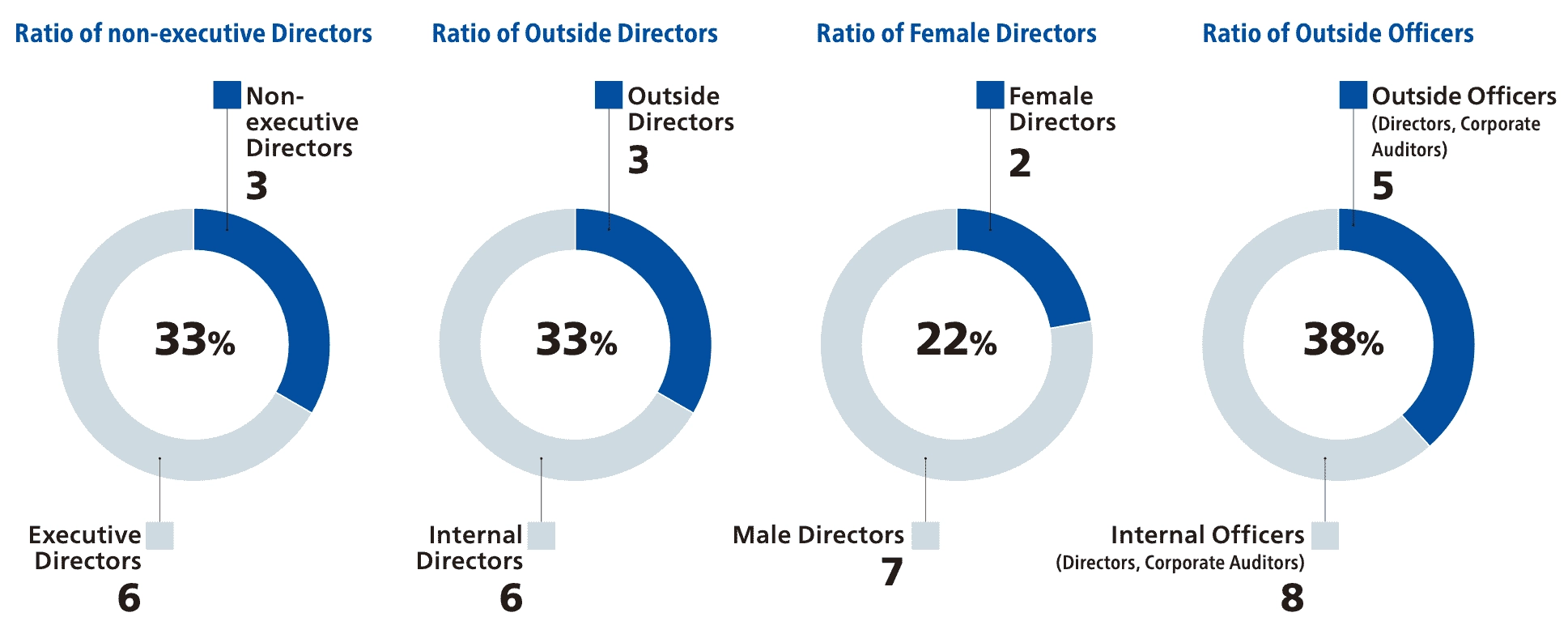

The current management structure comprises nine Directors (of whom two are women), including three outside Directors. Moreover, the Company has introduced a corporate

officer system to facilitate accelerated business decisions and to strengthen the business execution system, and has appointed 13 corporate officers, including six who

also serve as Directors. To clarify management responsibilities and to establish a management framework that can respond more quickly to changes in the business

environment, the term of office for Directors and corporate officers is set at one year.

Board of Directors

As entrusted by the Company’s shareholders, the Board of Directors assumes the responsibility for realizing efficient and effective corporate governance for the sake of all shareholders, achieving sustained growth for the Gunze Group as a result of realizing this level of corporate governance, and striving to maximize corporate value in the long term. To fulfill its responsibilities, the Board of Directors executes oversight functions over overall management practices in order to ensure fairness and transparency. The Board also nominates, evaluates, and determines remuneration for the President and other executives, while assessing important risks facing the Gunze Group and drawing up counteractions. The Board also makes important operational decisions to ensure the best possible decision-making for the Company. As a general rule, the Board of Directors meets once per month (held 13 times in FY2023), during which it makes decisions on important matters related to business execution and matters stipulated by laws, regulations, and the Articles of Incorporation. It also supervises the status of the execution of duties by Directors.

Executive Committee

Along with the Board of Directors, the Company also convenes the Executive Committee, which comprises the Representative Directors, the Managing Directors, Directors in charge of specific functions, and Corporate Officers (held 17 times in FY2023). This committee deliberates on important matters related to business execution, and seeks to accelerate decision making.

Nomination/Remuneration Committee

The Company established the Nomination/Remuneration Committee as an advisory body to the Board of Directors. Comprising one Representative Director and three outside Directors, and chaired by an outside Director, this Committee serves to strengthen fairness and objectivity in the nomination of candidates for Director and Corporate Auditor, appointing senior management, and determining compensation for Directors. In addition to deliberating remuneration content, amounts, and composition ratio by type as well as related regulations and proposing them to the Board of Directors, the Nomination/Remuneration Committee discusses the detailed handling of payments.

Internal Systems Concerning TimelyDisclosure of Corporate Information

Important facts decided or occurring in each division are centrally collected by the Information Officer without delay. With regard to “decided matters” and

“financial information,” the Information Officer discusses the need for disclosure with the relevant parties and then discloses them at the time a resolution is

made by the body that actually decides on the execution of the Company’s operations, such as a General Meeting of Shareholders or by resolution of the Board of

Directors. With regard to “incidents,” the Information Officer promptly discusses them with management, including the top management, as soon as he or she becomes

aware of their occurrence and puts in place a system for their timely and appropriate disclosure.

In the case of important company information, the disclosure of which has been decided, the information officer will immediately issue instructions to the

information disclosure officer, who will process disclosures in a timely and appropriate manner in accordance with the Timely Disclosure Rules and the Guidebook for

the Timely Disclosure of Corporate Information.

| Times held | Number of agenda items | Number of reports | Attendance (Internal Officers) | Attendance (Outside Officers) | |

|---|---|---|---|---|---|

| Board of Directors | 13 | 29 | 56 | 100% | 98% |

| Board of Corporate Auditors | 15 | 22 | 25 | 100% | 97% |

| Corporate Officers' Meeting | 17 | 66 | (included in the number of agenda items) | 100% | - |

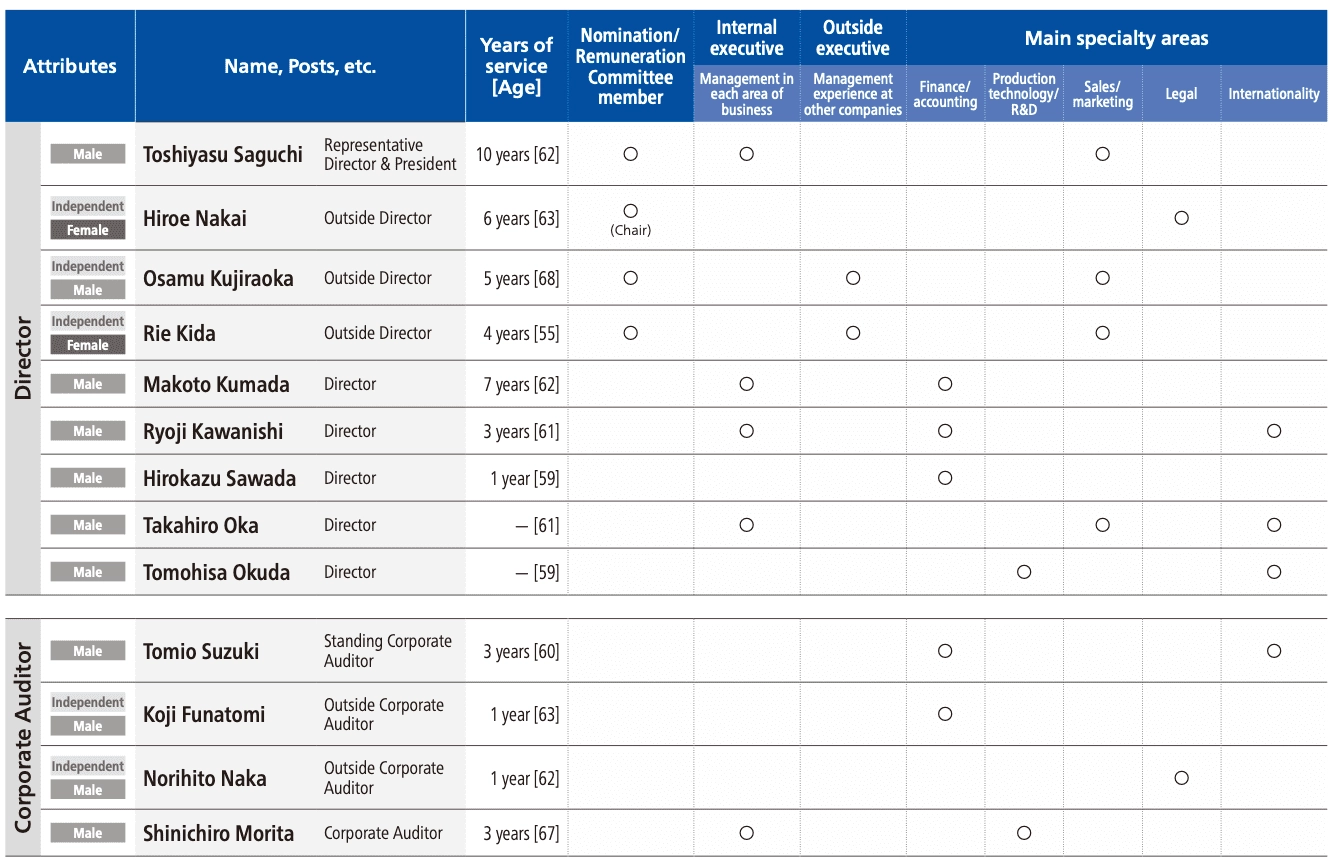

Director and Corporate Auditor Appointments As far as the nomination of Director and Corporate Auditor candidates and the appointment of senior management are concerned, the Nomination/Remuneration Committee deliberates on each matter based on the selection criteria stipulated by the Board of Directors, after which the Board of Directors makes a final decision. When deciding on candidates for Directors, we will take into consideration diversity, including gender and internationality, so that they will be able to make appropriate and prompt decisions regarding Gunze Group business activities in light of our management strategies. At the same time, our basic policy is to appoint internal Directors who possess knowledge, experience, and abilities in each of the business fields, as well as in finance and accounting, technology development and research, sales and marketing, legal affairs, and human resources. We also appoint multiple outside Directors who have management experience at other companies or specialized knowledge and experience outside the Company and can provide proactive advice and suggestions from a fair and objective standpoint, thereby constituting a well-balanced Board of Directors. In addition, the basic policy for Audit & Supervisory Board candidates is to be individuals of excellent character with insight, ability, and abundant experience, as well as high ethical standards, and at least one Audit & Supervisory Board member must possess appropriate knowledge regarding finance and accounting. The Audit & Supervisory Board must be composed of individuals who can present fair opinions from expert perspectives and independent standpoints.

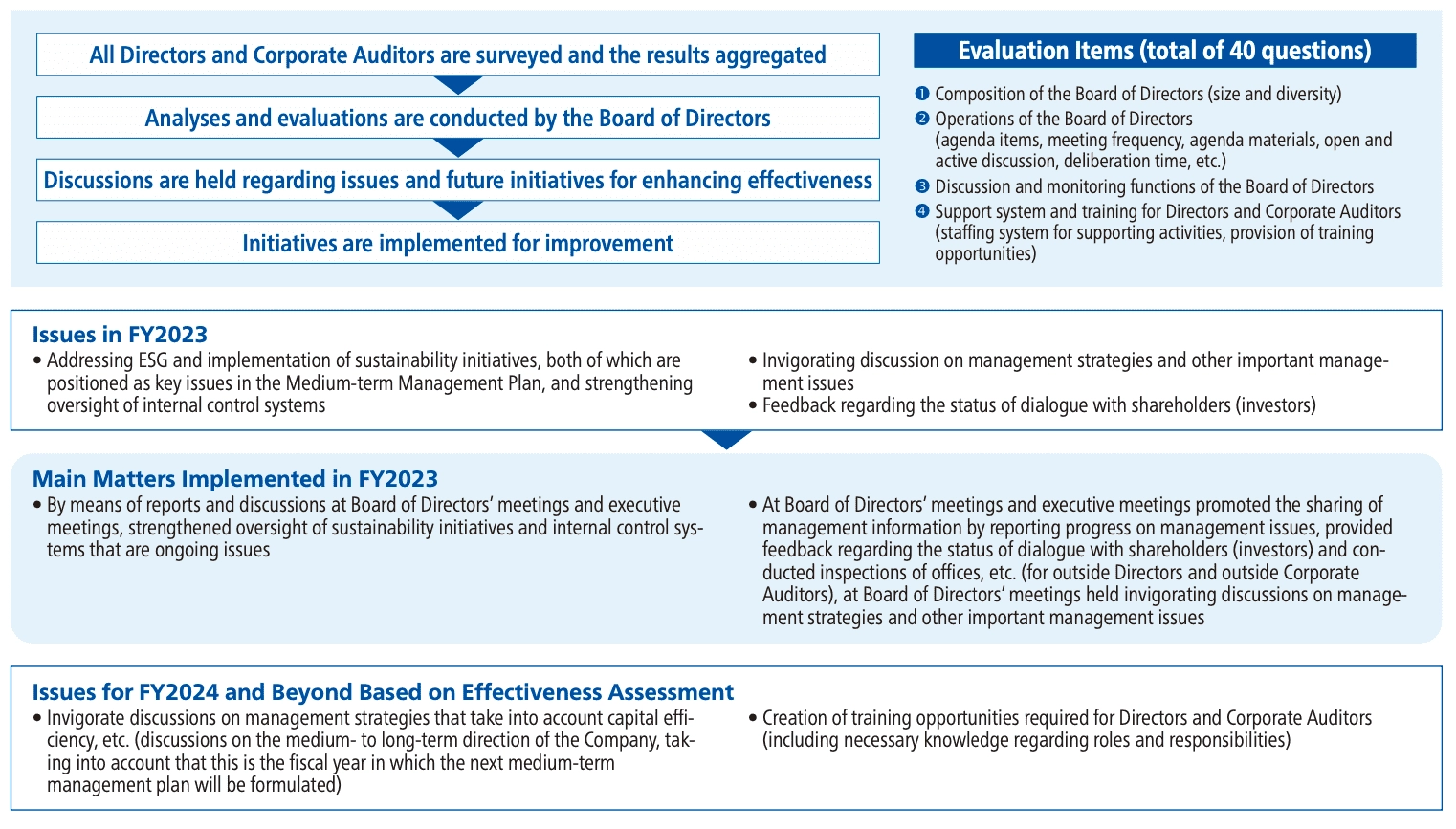

Assessment of Board of Directors’ Effectiveness

At the Gunze Group, all Directors and Corporate Auditors conduct an annual assessment on the effectiveness of the Board of Directors as well as their own performance as

Company officers and submit their results to the Board of Directors. Based on the aggregate results, the Board of Directors analyzes and evaluates its overall

effectiveness. Since FY2019, the Board of Directors has been conducting self-evaluations and analyses with advice from an external organization on the aggregate

results, the results were reported, discussed, and evaluated at the annual meeting of the Board of Directors held in May 2023.

In March 2024, all Directors and Corporate Auditors who comprise the Board of Directors were the subject of a survey conducted by the Company, and as they responded

directly to an external organization, they were assured anonymity in their responses. Based on the report and advice from the external organization on the aggregate

results, an evaluation and discussion were conducted at the annual meeting of the Board of Directors held in May 2024. As a result, generally positive evaluations were

obtained in terms of composition, operations, agenda items, execution of individual roles, and mutual supervision, among others. Taking into consideration the changes

in the evaluation results following the employment of the external organization and comparisons with the previous year’s evaluation and external data, we believe that

the effectiveness of the Board of Directors as a whole has been ensured.

Board of Directors’ Deliberations In addition to matters stipulated by laws, regulations, and the Articles of Incorporation, quarterly settlements, the next fiscal year’s policies, operating budgets, and other individual matters are discussed as important business matters, and reports and information from each executive division are shared in a timely and appropriate manner. For each proposal and report, outside Directors and others proactively ask questions, raise issues, and hold discussions from a variety of perspectives, including checking the progress toward realizing the Medium-term Management Plan VISION 2030 stage1. In FY2023, discussions were held and proposals, reports, and decisions made on a number of items, including the creation of an independent segment for the medical business as a growth business, the construction of a new (third) factory, the expansion of R&D facilities, the expansion of the main factory in the engineering plastics field, the establishment of new companies in the apparel business (Ballelite Co., Ltd. and SEESAY Co., Ltd.), and structural reforms in the electronic components field, mechatronics field, apparel business, and sports club field.

Main Activities of Corporate Auditors The main activities of the Audit & Supervisory Board members are as follows. The main activities carried out by the full-time and part-time Audit & Supervisory Board members are marked with a ● or ○.

| Activities |

Number of times, etc. |

Job assignments | ||

|---|---|---|---|---|

| Full-time |

External part-time |

Part-time | ||

| Attendance, expressing of opinions at Board of Directors’ meetings | 13 times | ● | ● | ● |

|

Attendance, exchanging of opinions at meetings of outside Directors (reporting sessions on initiatives from head office and business divisions) |

9 times | ● | ● | ● |

|

Attendance, expressing of opinions at other important meetings (Executive Committee meetings, budget meetings, business group head meetings, risk management and other committee meetings) |

39 times | ● | ○ | |

|

Viewing, verification of important documents (approval documents, such as requests for approval, important contracts) |

As needed | ● | ○ | |

|

Individual meetings and exchanging of opinions with Directors (including one exchange of opinions with outside Directors) |

17 times | ● | ○ | ○ |

|

Individual interviews with corporate officers and senior employees, hearings on business execution status, and exchanges of opinions |

73 times | ● | ○ | ○ |

| Visits to and surveys of major offices and affiliated companies | 26 entities | ● | ○ | ○ |

| Attending inventory inspections at major business sites and affiliated companies | 3 entities | ● | ● | |

|

Surveys, monitoring and verification of internal control system and its operational status (based on above activities) |

Checklist collection | ● | ○ | ○ |

|

Cooperation with subsidiary auditors (Group auditors’ liaison meetings, individual communications) |

Liaison meetings two times |

● | ○ | ● |

|

Cooperation with internal audit divisions (meetings to confirm audit plans, receive regular reports, etc.) |

9 times | ● | ○ | ● |

|

Cooperation with independent accounting auditors (meetings relating to audits and reviews, etc.) |

12 times | ● | ○ | ○ |

○:Partial responsibility

Director and Corporate Auditor Training

Immediately after taking up their posts, newly appointed Directors of the Company, including independent outside Directors, are required to participate in training

programs offered by the Director in charge of legal affairs and compliance or external attorneys at law. They are also to be informed about management strategies,

financial positions, and other important matters by the President or Director(s) in charge of executing business operations or other executives named by the

President.

To fulfill their respective roles, the Directors and Corporate Auditors are required to proactively collect information regarding financial positions, legal and

regulatory compliance, corporate governance, and other matters. They must also continuously strive to improve their knowledge and skills. Expenses required for

participating in external training and seminars are borne by the Company as claimed.

Succession Plan Under the recognition that the development of a successor for the President is an important matter for management, following deliberations by the Nomination/Remuneration Committee, the Board of Directors formulates a succession plan that specifies qualifications for the post of president and a candidate development policy, and provides final approval for the plan. The Board of Directors shares this president succession plan among all members of the Board, periodically confirms the development status of senior management with the potential to succeed the President made by the Nomination/Remuneration Committee, and determines a candidate for succeeding the President in accordance with the succession plan when the current President steps down from this post.

Executive Remuneration System

Bonuses are paid to Directors as performance-linked bonuses at a fixed time each year.

The performance indicator selected as the basis for calculating the performance-linked bonuses is the Gunze Value Added (GVA) value for each fiscal year. The reason

for selecting this performance indicator is that it is linked to the Gunze Group’s business performance and shareholder interests, and we determined that it is the

most appropriate indicator for raising awareness of improving business performance each fiscal year.

The amount of the performance-linked bonus is calculated by multiplying each individual executive’s monthly remuneration by the executive bonus coefficient

established for each position and the performance-linked coefficient corresponding to the increase/decrease in GVA relative to performance forecasts. The actual GVA

for the fiscal year under review was a deficit of 1.6 billion yen (a deficit of 2.3 billion yen in the previous fiscal year).

To raise awareness of the need to improve corporate value over the medium to long term, Directors (excluding outside Directors) are paid restricted stock at a fixed time each year as performance-linked stock compensation. The performance indicators selected as the basis for calculating the amount of performance-linked stock remuneration are a relative evaluation of Total Shareholders Return and TOPIX for each fiscal year, as well as an evaluation based on the degree of achievement of the Companywide CO2 emissions reduction target. The reason for selecting this performance indicator is that it was adjudged to be the most appropriate indicator for further promoting the sharing of shareholder value with shareholders, raising awareness of contributions to improving the corporate value of the Gunze Group, and for promoting business activities that reduce the environmental burden. The amount of performance-linked stock compensation is calculated by multiplying the monthly compensation amount of each executive officer by a coefficient (fixed portion and variable portion) determined for each position. The variable portion is calculated by multiplying the performance-linked coefficient according to the relative evaluation of TSR and TOPIX and the degree of achievement of the Companywide CO2 emissions reduction target.

| Remuneration type | KPI (performance indicators) |

|---|---|

| Bonus |

|

| Stock compensation |

|

| Remuneration type | Total amount of remuneration (millions of yen) | Total amount of remuneration by type (millions of yen) | Number of eligible officers | ||

|---|---|---|---|---|---|

| Fixed compensation | Performance-linked compensation | Non-monetary compensation | |||

| Directors (excluding outside Directors) |

185 | 100 | 42 | 43 | 6 |

| Corporate Auditors (excluding outside Corporate Auditors) |

24 | 24 | - | - | 2 |

| Outside Directors | 21 | 21 | - | - | 3 |

| Outside Corporate Auditors | 14 | 14 | - | - | 4 |

The number of eligible officers includes two outside Corporate Auditors who retired at the conclusion of the Ordinary General Meeting of Shareholders held in June 2023.

Message from Chairperson of Nomination/Remuneration Committee

Toward “Creating an Organizational Culture in which Diverse Human Resources Can Thrive”

Gunze has set the “evolution of a corporate culture” as one of the strategies for its 2030 vision and cited “creating an organizational culture in which diverse

human resources can thrive” as a specific strategy. The Nomination and Remuneration Committee likewise intends to work to evolve the corporate culture with the

ultimate goal of “creating an organizational culture in which diverse human resources can thrive.” With regard to compensation, firstly, we aim to provide strong

motivation to achieve Gunze’s goals, primarily through a performance-linked system, and secondly, to strengthen our competitiveness by examining and verifying that

the compensation system is clear and fair.

In preparation for the 2024 Ordinary General Meeting of Shareholders, we deliberated on issues such as “the number and structure of Directors, and human resource

requirements based on a skills matrix” and selected Director candidates (including new appointees) with the necessary experience and skills from among those on

nominator lists. Following the passing of a resolution at the Ordinary General Meeting of Shareholders, the Board of Directors has been restructured, and with this

new lineup I am expecting us to be able to solidify our structure for the next medium-term management plan and to increase the effectiveness of our management,

allowing us to move on to the next step. With this new structure in place, the Chairman and Representative Director has stepped down from his position, but he has

been appointed as an Advisor to continue his external affairs, including as the representative of external organizations. I am also expecting our advisors to use

their experience and knowledge to provide advice with regard to Company management-related decisions.

Hiroe Nakai

Outside Director

Chairperson of Nomination/ Remuneration Committee

Promoting Compliance

I recognize the importance of compliance in sustainably boosting our corporate value. Legal & Compliance regularly conducts the necessary education and training and

streams training videos on the Company’s intranet for members, for example, in an effort to convey an appropriate understanding of compliance. In FY2022, we began

holding hybrid training programs for new employees consisting of e-learning and in-person training conducted by lecturers from Legal & Compliance. In addition to

sharing Gunze’s sense of ethics, we now hold follow-up training with the aim of deepening understanding of insider trading regulations and of cautionry points regarding

social media use, which is essential knowledge regardless of department or area of responsibility.

To coincide with the enforcement of the Amendments to the Act for Eliminating Discrimination against Persons with Disabilities, we also conducted training on the

appropriate considerations that the Gunze Group should take, so that all customers who use Group-operated stores and facilities can continue to use them with peace of

mind.

In addition, our internal whistleblower “Advice Hotline” provides consultations regarding compliance and other issues and works to resolve them while taking into

consideration the privacy of those involved. Having also established an external whistleblower hotline staffed by outside attorneys, we have secured a route for

attorneys to report directly to corporate auditors in the event of a report that falls under the category of public interest whistleblowing. In FY2023, there was one

consultation or report subject to public interest reporting.

In addition, our internal whistleblower “Advice Hotline” provides consultations regarding compliance and other issues and works to resolve them while taking into

consideration the privacy of those involved. Having also established an external whistleblower hotline staffed by outside attorneys, we have secured a route for

attorneys to report directly to corporate auditors in the event of a report that falls under the category of public interest whistleblowing. In FY2023, there was one

consultation or report subject to public interest reporting.

| Cases | Fiscal 2022 | Fiscal 2023 | ||

|---|---|---|---|---|

| Hotline | External reporting desk | Hotline | External reporting desk | |

| Workplace relationships | 6 | 0 | 4 | 0 |

| Sexual harassment | 1 | 0 | 2 | 0 |

| Power harassment | 7 | 1 | 4 | 0 |

| Facts subject to whistleblowing | 0 | 0 | 1 | 0 |

| Others | 4 | 0 | 7 | 0 |

| Total | 18 | 1 | 18 | 0 |

Strengthening the Risk Management System

The Gunze Group has established a Risk Management Committee to prevent risks in general and respond appropriately to unforeseen situations and contingencies. With the

goal of eliminating industrial accidents, misconduct, and all forms of harassment, we are identifying specific risks and working on measures to minimize them. The Risk

Management Committee met four times in FY2023, during which it received monitoring result reports from the main departments designated to take charge of each of these

risks, verified the execution status of countermeasures, and discussed and determined future action. These initiatives are reported to the Board of Directors, which

issues instructions as necessary to ensure the effectiveness of internal controls.

In FY2023, we placed particular emphasis on providing a safe working environment for employees, and with the eradication of industrial accidents in mind proceeded with

earthquake resistance inspections of each business location and the demolition of aging facilities.

As a responsibility of a manufacturer and seller of products, we must not only avoid any violations of the Act against Unjustifiable Premiums and Misleading

Representations or the Act on Securing Quality, Efficacy and Safety of Products Including Pharmaceuticals and Medical Devices (the Pharmaceutical and Medical Device

Act) but also the risk of causing inconvenience to customers through inappropriate language in products or advertisements. In accordance with the increasing number of

opportunities to provide apparel products by online sales in particular, it is becoming increasingly important to use labels and expressions that are appropriate for as

many people as possible. We are working to minimize risk by having staff from multiple departments use an in-house database to check the labeling and expressions of

products delivered to customers in advance and by conducting in-house training.

Gunze Corporate Governance GuidelinesEstablished: December 18, 2015

Revised: April 1, 2017

Revised: March 3, 2019

Revised: June 16, 2020

Revised: June 16, 2021

PrefaceIn conformance with its “quality first” policy and its commitment to “technology-oriented management,” the Gunze Group (hereinafter referred to as “the Group”) proactively strives to fulfill corporate social responsibility (CSR). In doing so, the Group lives up to its founding philosophy that underscores a “people-oriented approach,” a “commitment to quality,” and “harmonious coexistence.” With a strong determination to provide customers with a “Feeling of Comfort” through the products and services offered by each business line, the Group also aims to become “a corporate group that fulfills the needs of society” and “a corporate group that grows sustainably alongside society.” To this end, it is vital that the Group attain sustained growth and enhance corporate value on a long-term basis, so as to offer our shareholders a sense of assurance and motivate them to hold the Company’s stock for a long period of time. As such, Gunze established these guidelines based on the resolution of a meeting of the Board of Directors for the purpose of realizing the best possible corporate governance practices. Any revisions to the Guidelines will be released in an appropriate and timely manner once they are made.

Chapter 1 General ProvisionsBasic Stance for Corporate Governance

- Article 1

- In pursuit of the best possible corporate governance practices, the Group continuously strives to enhance its corporate governance system.

- 2

-

The Group recognizes that legal and regulatory compliance is essential for continuously boosting its corporate value. Furthermore, efforts are concentrated on swift

decision-making in response to social and economic environments, and timely disclosure of appropriate information so as to improve transparency of management. The Group

considers that one of its most important management objectives is to enhance shareholder value by taking these measures. To make this possible, the Group strives to

upgrade and strengthen its internal control functions, while also building sound relationships with all its stakeholders. In accordance with its basic stance discussed

below, the Group works on enhancing its corporate governance system.

- (1) We value the rights of all shareholders and ensure equal treatment among them.

- (2) We endeavor to appropriately cooperate with our stakeholders including shareholders by taking their interests into consideration.

- (3) We ensure appropriate information disclosure and transparency.

- (4) We establish an organizational structure that makes proactive use of independent outside directors, so as to facilitate effective oversight of business execution by the Board of Directors.

- (5) We engage in constructive dialogue with shareholders with a policy of investment that focuses on medium- to long-term shareholder interests.

Chapter 2 Securing the Rights and Equal Treatment of ShareholdersGeneral Shareholders Meeting

- Article 2

- To ensure that shareholders are provided with sufficient time to carefully consider the agenda for a general shareholders meeting to exercise their rights, the Company sends a notice of convocation at least three (3) weeks before the date of a general shareholders meeting. Also the Company promptly discloses the information included in the notice of convocation on the Company’s website.

- 2

- The Company strives to maintain an environment in which all shareholders including those who do not attend the meeting can properly exercise their rights, by using the Tokyo Stock Exchange’s (TSE) Electronic Voting Platform and other measures. To this end, the Company arranges the annual general shareholders meeting to be days apart from the so-called “date of the highest concentration of general shareholders meetings” whenever possible.

Securing Equal Treatment of Shareholders

- Article 3

- The Company equally treats shareholders based on the number of shares they hold, and discloses information in a timely and appropriate manner so as to avoid creating a difference in the amount of information received among shareholders.

Basic Policy for Cross-shareholdings and Voting Rights Thereto

- Article 4

- Based on its principle of “harmonious coexistence” as stated in its Founding Philosophy, the Company aims to build relationships of trust with customers and business partners and facilitate smooth business transactions. To this end, the Company may occasionally hold shares of other listed companies as cross-shareholdings. As for shares of major customers/partners, the Board of Directors will regularly examine the objectives and rationale behind cross-shareholdings.

- 2

- With respect to the voting rights attached to the shares it holds, the Company exercises the rights by respecting the other company’s management policy and making comprehensive judgment from the perspective of that company’s medium- to long-term improvement of corporate value and impact on the Company’s business, etc.

Support for corporate pensions, conflict of interest management

- Article 5

- In order to properly manage the defined benefit corporate pension plan, the Asset Management Committee, which is headed by the director in charge of finance and consists of members appointed from the Company and the labor union, determines the asset management policy, selection of trustees, and specific asset composition ratio, etc., and important management matters are implemented upon approval by the Executive Committee. Important management matters are implemented after obtaining the approval of the Executive Committee.

- 2

- For the members of the Asset Management Committee, we will appoint people with the necessary experience and qualifications, and endeavor to train them.

Chapter 3 Considering Stakeholder InterestsEthical Standards and Conflict of Interest

- Article 6

- The Company ensures that all its employees are fully informed of the Gunze Activity Guidelines, established to provide a guide for actions and behaviors they should take to put Gunze’s management philosophy into practice. These guidelines are also released externally.

- 2

- Should any issue arise regarding conflict of interest with the company or shareholders with respect to transactions with a director, such a director must report to the Board of Directors in accordance with the Companies Act and get approval from the Board.

Relationships with Stakeholders

- Article 7

- Aiming to improve corporate value over the long term, the Group lives up to its corporate philosophy, corporate motto, and Gunze Activity Guidelines, which are woven as the “warp” threads of the corporate fabric. While doing so, the Group remains sensitive to the demands and expectations of all stakeholders in order to flexibly and sincerely meet these demands. The Group also promotes fair and honorable corporate activities as it seeks to fulfill its social responsibilities, attaining sustainable development together with society and the global environment.

- 2

- The Company has a whistleblower system in place to allow employees to seek advice and report on compliance-related issues. Should an employee discover a serious violation of laws or regulations or an important incident regarding compliance, the employee should promptly report directly to the President or the director/corporate officer in charge of compliance. Especially important issues will be reported to the Audit & Supervisory Board members without delay. The necessity of taking measures to protect whistleblowers from any detrimental treatment is clearly stipulated in the working regulations and other related in-house rules.

Chapter 4 Ensuring Appropriate Information Disclosure and TransparencyDisclosure of the Company’s Policies for Risk Management, Internal Control Systems, etc.

- Article 8

- In compliance with the Companies Act and other applicable laws and regulations, the Board of Directors determines the Company’s policies for risk management, internal control system, and legal and regulatory compliance of the Company and the corporate group including the Company, and discloses them in a timely and appropriate manner.

- 2

- The Board of Directors releases financial and business information in a fair, detailed and easy-to-understand manner in compliance with the Companies Act, Financial Instruments and Exchange Act, and other applicable laws and regulations, as well as financial instruments exchange rules.

Chapter 5 Roles and Responsibilities of the Board of Directors, etc.Clause 1 Responsibilities of the Board of Directors as a Supervising Body

Roles of the Board of Directors

- Article 9

- As entrusted by the Company’s shareholders, the Board of Directors assumes the responsibility of implementing efficient and effective corporate governance for the sake of all shareholders who seek to promote their interests through maximization of the Company’s corporate value on a long-term basis. Through this governance, the Board is responsible for ensuring that the Company achieves sustained growth and strives to maximize corporate value in the long term.

- 2

- To fulfill its responsibilities set forth in the preceding paragraph, the Board of Directors executes oversight functions over overall management practices in order to ensure fairness and transparency. The Board also nominates, evaluates, and determines remuneration for the President and other executives, while assessing important risks facing the Company and drawing up counteractions. The Board also makes important operational decisions to ensure the best possible decision-making for the Company.

Roles of Independent Outside Directors

- Article 10

- The main tasks of the Company’s independent outside directors include verification and evaluation of the results of the Company’s management and performance of the management team as necessary in light of the management strategy or plan determined by the Board of Directors. From the perspective of collective interests of all shareholders, the outside directors are also tasked with judging and determining whether it is appropriate to put the Company’s management into the hands of the present management team and expressing their opinions.

Chair of the Board of Directors

- Article 11

- The Chairman of the Company will take on the position of the chair of the Board of Directors. Should the post of the Chairman be vacant, the President shall take over the position of the chair of the Board.

- 2

- The chair of the Board of Directors strives to raise the quality of discussions and facilitate efficient and effective operation of the Board. To fulfill this responsibility, the chair of the Board must make arrangements to ensure that a sufficient amount of time is available for discussions on all items on the agenda, and that each director is provided with appropriate information on a timely basis.

Clause 2 Effectiveness of the Board of Directors

Composition of the Board

- Article 12

- The Company’s Board of Directors shall consist of a maximum of 15 members, including at least two (2) independent outside directors, who conform to the applicable provisions of the Companies Act and satisfy the independence criteria of the Tokyo Stock Exchange’s rules, and who do not have the possibility of conflicts of interest with the Company’s general shareholders.

- 2

- The Company adopts a Corporate Officers System to clearly separate decision-making regarding business practices and management oversight functions from execution of business operations, and to augment the Board’s monitoring functions. It is also intended to vitalize the Board and facilitate quicker decision-making.

- 3

- To enhance the Board’s functions and improve management efficiency, the Company holds an executive officers meeting attended by representative directors, senior managing and managing directors, directors and corporate officers assigned with specific functions, and others to deliberate upon important matters regarding the Group’s business operations.

Qualifications for Directors and Nomination Procedures

- Article 13

- The Company’s directors must have an excellent personality, good insight, high skill, abundant experience, as well as a strong sense of ethics.

- 2

- Upon selecting candidates for directors, the Company’s basic policy is to create a well-balanced Board that is constituted in a manner to achieve diversity in order to ensure swift and proper decision-making and effective oversight of the Group’s business activities. To do so, the Company selects directors with knowledge, experience, and skill regarding various business fields, human resources management, finance and accounting, as well as R&D of technologies from the Company’s human resources. The Company also selects a number of outside directors who are capable of actively providing advice and suggestions from a fair and objective standpoint based on their expert knowledge and experience.

- 3

- All directors of the Company shall be elected subject to approval at the general shareholders meeting of each year.

- 4

-

Candidates for new directors (including substitute directors) shall be determined at a meeting of the Board of Directors based on the provision of this Article.

This will be done after undergoing deliberation by the representative directors and outside directors regarding the balance of the Board composition in terms of knowledge, experience, skill, diversity, and scale.

Qualifications for Audit & Supervisory Board Members and Nomination Procedures

- Article 14

- The Audit & Supervisory Board members of the Company must have excellent personality, good insight, high skill, abundant experience, as well as a strong sense of ethics. At least one (1) member of the Audit & Supervisory Board must have sufficient knowledge and expertise on finance and accounting.

- 2

- Candidates for new Audit & Supervisory Board members (including substitute members) shall be determined at a meeting of the Board of Directors based on the provision of this Article after undergoing deliberation by the representative directors and outside directors, and after receiving the consent of the Audit & Supervisory Board.

Term of Office of Independent Outside Directors and Limitations to Concurrent Posts

- Article 15

- The Board of Directors stipulates in its independence criteria that outside directors and outside Audit & Supervisory Board members, who have held their office for a term exceeding eight (8) years since they first assumed their office, do not satisfy eligibility criteria for independent outside directors and independent outside Audit & Supervisory Board members, respectively. However, outside corporate auditors who are in the middle of their term may continue to serve until the end of their term.

- 2

- The outside directors and outside Audit & Supervisory Board members of the Company must not concurrently assume posts of director or Audit & Supervisory Board member at more than three (3) listed companies besides Gunze Limited.

Business Performance Indicators

- Article 16

- The Board of Directors specifies management indicators and target values used by the Board to assess the performance of the President and other directors in a medium-term management plan, etc. as necessary, and discloses them in a timely and appropriate manner.

Succession Planning

- Article 17

- The Company has established a directors’ retirement system in order to promote appropriate circulation and succession of directors and Audit & Supervisory Board members.

- 2

- The President shall be aware that the development of a successor is one of the important responsibilities of the President, and should formulate a succession plan that specifies qualifications for the President and a development policy, by reflecting the opinions of independent outside directors as well.

- 3

- The Board of Directors shall share the president succession plan set forth in the preceding paragraph among all members of the Board and determine a candidate for succeeding the presidency in accordance with the succession plan when the current President steps down from this post.

Responsibilities of Directors

- Article 18

- Directors must collect a sufficient amount of information necessary for performing their duties and engage in exhaustive discussions by proactively expressing views and opinions.

- 2

- Directors shall demonstrate their capabilities as expected and spend enough time for the Company in order to perform directors’ duties.

- 3

- Upon assumption of their offices, the directors of the Company must fully understand related laws and regulations, the Articles of Incorporation of the Company, Rules of the Board of Directors, and other in-house rules, and be fully aware of their duties.

Self-improvement and Training of Directors and Audit & Supervisory Board Members

- Article 19

- Immediately after taking on their posts, the newly appointed directors of the Company (including independent outside directors) shall participate in training programs offered by the director in charge of legal affairs and compliance or external attorneys at law. They should also be informed about the Company’s management strategies, financial positions, and other important matters by the President or director(s) in charge of executing business operations or other executives named by the President.

- 2

- To fulfill their respective roles, the directors and Audit & Supervisory Board members of the Company shall proactively collect information regarding the Company’s financial positions, legal and regulatory compliance, corporate governance, and other matters. They should continuously strive to improve their knowledge and skills.

- 3

- Expenses required for participating in external training/seminars shall be borne by the Company as claimed.

Setting the Agenda for Board of Directors Meetings, etc.

- Article 20

- At the Board meeting to be held at the end of each fiscal year, the chairperson of the Company’s Board of Directors shall decide on the main items for the agenda of the following fiscal year’s Board meetings regarding the Company’s business strategies, risks, and internal controls, taking each director's suggestion and opinion into account.

- 2

- Information materials for the agenda and proposals for the Company’s Board of Directors meetings must be distributed to all directors, including outside directors, far in advance of the date of the meeting so that constructive discussions can be conducted at each Board of Directors meeting. Particularly for outside directors, the director/corporate officer in charge of finance or other executives shall explain the information materials in advance.

Access of Outside Directors and Audit & Supervisory Board Members to In-house Information

- Article 21

- The outside directors and Audit & Supervisory Board members of the Company may request that inside directors, corporate officers, and/or employees give briefings or make reports whenever necessary or deemed appropriate, and seek submission of in-house information.

- 2

- The Company sets up the Audit & Supervisory Board Secretariat by providing it with sufficient staff and budget to support the Board of Audit & Supervisory Board and its members in appropriately performing their duties.

Outside Directors Meeting

- Article 22

- Independent outside directors of the Company shall periodically meet to deliberate on matters regarding the Company’s business and corporate governance, while also receiving reports from inside directors or other executives such as corporate officers. Audit & Supervisory Board members will also attend these meetings as necessary.

Self-assessment

- Article 23

- Directors shall conduct self-assessment of their own performance of directors’ duties as well as the effectiveness of the Board of Directors every year and submit the results of the assessment to the Board. Based on each director’s self-assessment, the Board will analyze and evaluate the effectiveness of the Board as a whole, and disclose the outline of the results of evaluation in a timely and appropriate manner.

Clause 3 Remuneration System

Remuneration, etc. for Directors and Other Executives

- Article 24

- Remuneration, etc. for directors in charge of business execution shall be linked to the long-term interests of the Company’s shareholders. At the same time, they must be set appropriately and in a fair and well-balanced manner so as to fully motivate the directors to maximize the value of the Company.

- 2

- The total amount of remuneration, etc. for directors shall be specified through deliberation by the representative directors and outside directors based on the remuneration limit for directors resolved at a general shareholders meeting, and decided on at a meeting of the Board of Directors.

- 3

- The amounts of remunerations, etc. for individual directors shall be decided by referring to the levels of remunerations, etc. of other companies that are appropriate gauges of comparison, and by considering the balance against remuneration of employees. The amounts of bonuses shall be determined by taking into consideration the status of business execution and business results. Directors excluding outside directors will be granted compensation-based stock options as incentives for improvement of medium- to long-term performance and corporate value.

- 4

- Remuneration, etc. for outside directors must reflect the time during which each director is involved with the Company’s business and each director’s duties, and must not include any proportions linked to the Company’s business results, such as stock compensation.

Chapter 6 Dialogue with Shareholders

Dialogue with Shareholders

- Article 25

- The Company strives to ensure that the views of shareholders are thoroughly considered by all members of the Board of Directors.

- 2

- The Company shall engage in dialogue regarding corporate governance and other important management policies as necessary, with main shareholders with investment policies focusing on medium- to long-term shareholder interests. When engaging in such dialogue, the Company shall be careful not to create any information gap between shareholders.

- 3

- The Company shall set forth and disclose basic policies for the establishment of a system and initiatives intended to promote constructive dialogue with shareholders.

(Attachment)

Basic Policy for Constructive Dialogue with Shareholders

In order to contribute to sustainable enhancement of corporate value over the medium- to long-term, Gunze Limited (hereinafter referred to as “the Company”) has specified the basic policy for constructive dialogue with shareholders as follows:

- 1

- The Public & Investors Relations Section, under the direct control of the President, is mainly in charge of maintaining a dialogue (meetings) with shareholders or institutional investors in collaboration with other related departments. Directors and other senior executives including the director/corporate officer in charge of finance will engage in these meetings as necessary.

- 2

- The Company arranges presentations for analysts and institutional investors twice a year, in which the President, the director/corporate officer in charge of finance and other senior executives provide explanations about financial results and other matters. Small meetings are also organized as necessary. For individual investors, the Company sets up explanatory sessions at IR events organized by security firms.

- 3

- Views and other input from shareholders and investors obtained through dialogue are compiled by the Public & Investors Relations Section, and fed back to directors and other executives, in order to incorporate suggestive input in its medium- to long-term management policies.

- 4

- When interacting with shareholders and investors, the company shall thoroughly adhere to the "Rules on Disclosure of Information," "Rules on Regulation of Insider Trading and Management of Inside Information," and "Policy on Disclosure of Information," and pay attention to fair disclosure and management of insider information.