battery external view

lithium-ion batteries

About GUNZE

Business

Research & Development

Sustainability

Investor Relations

Basic Concept

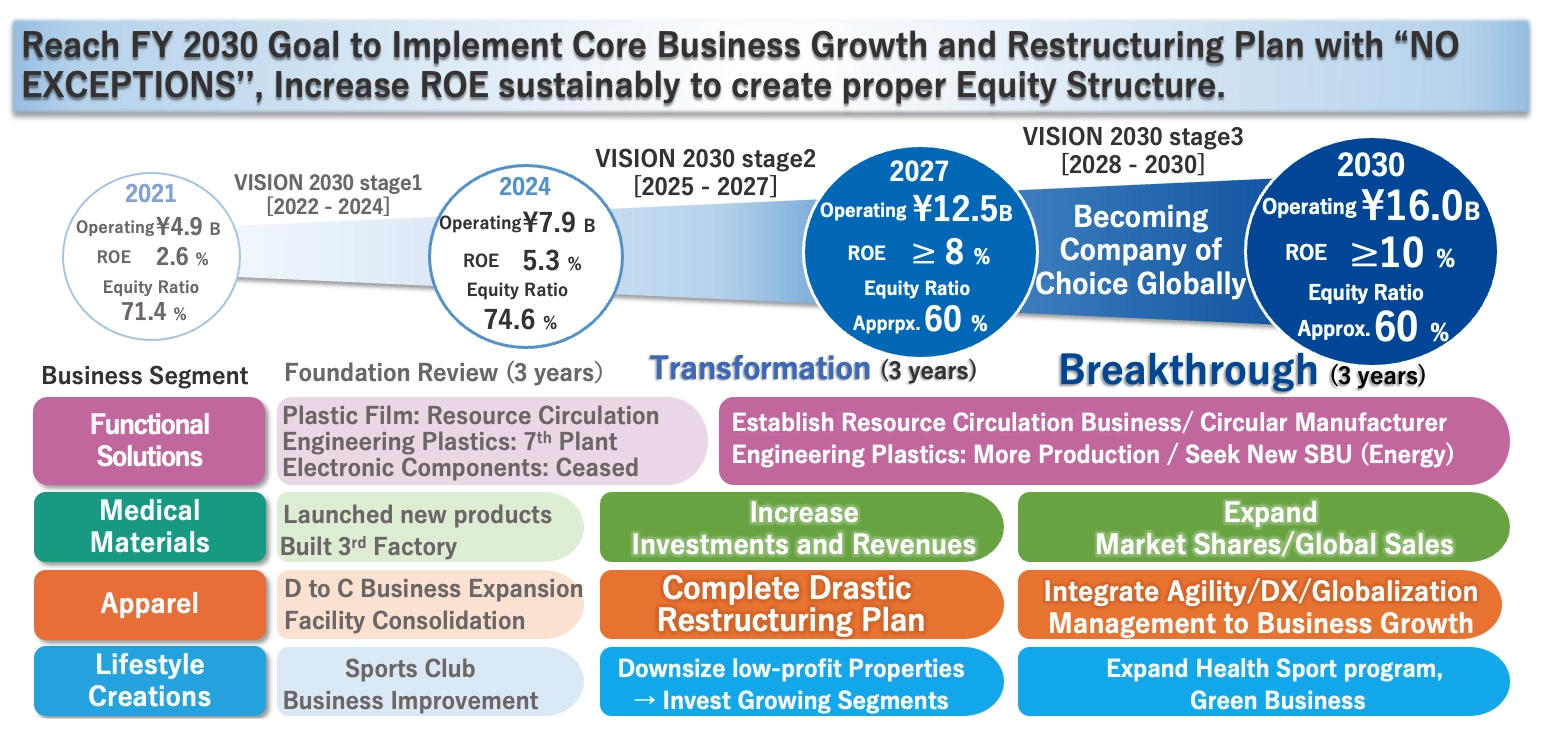

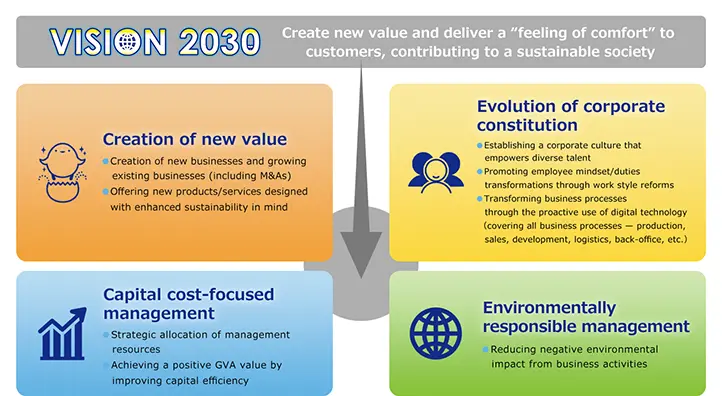

To Be “Company of Choice Globally”, Advance Sustainable Business Foundation

Summary

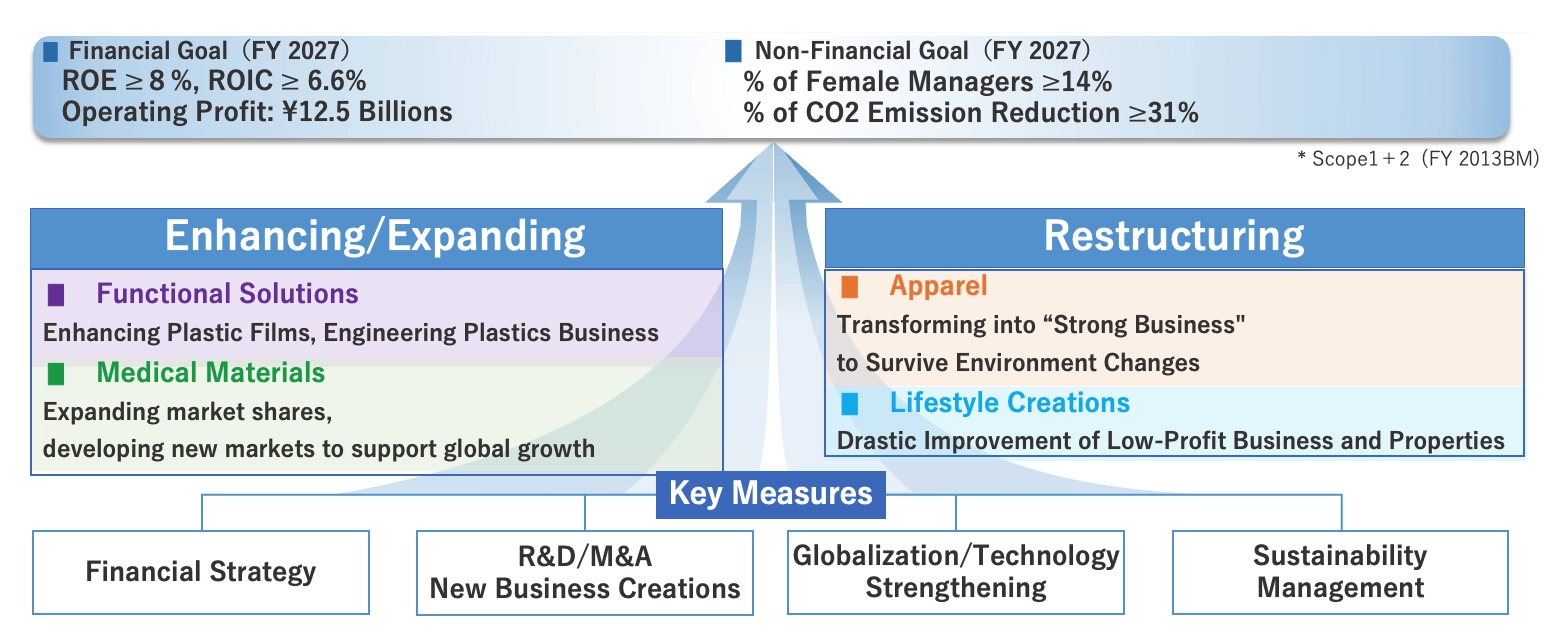

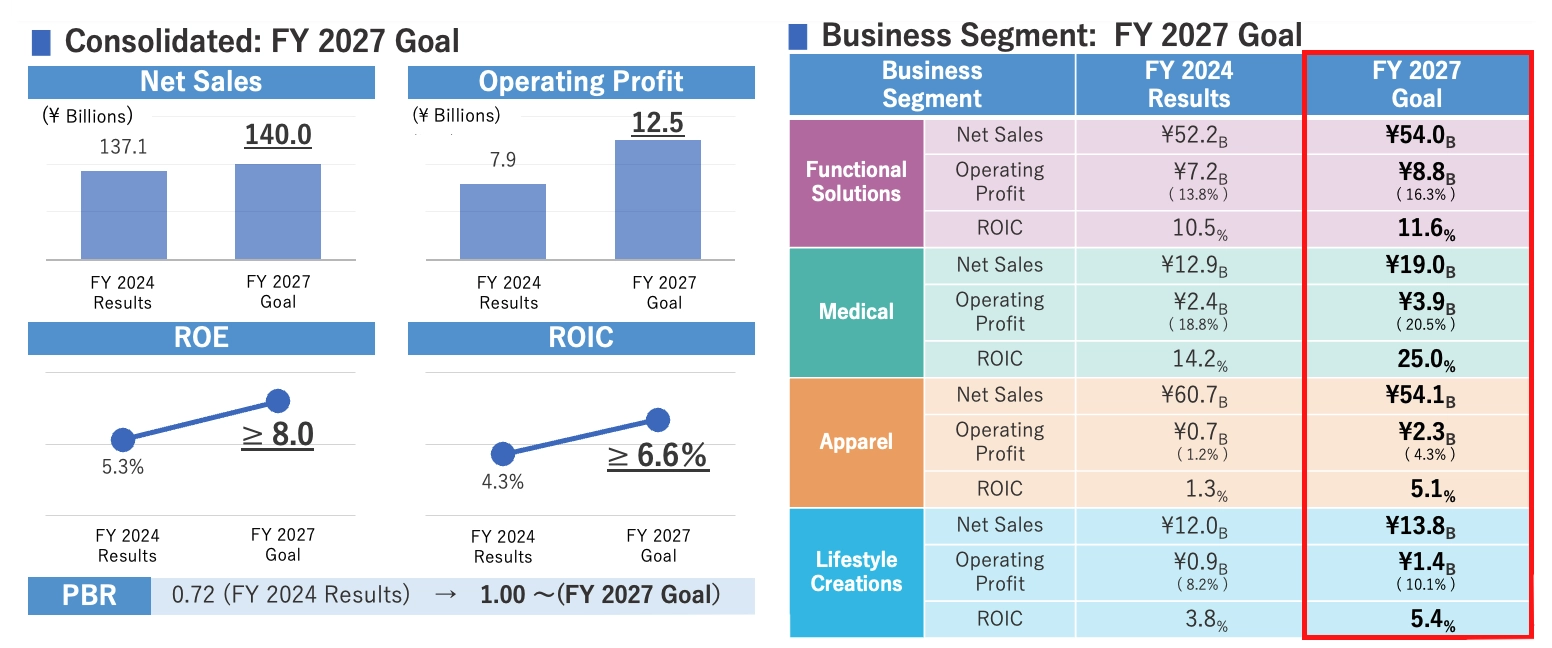

Financial Goal

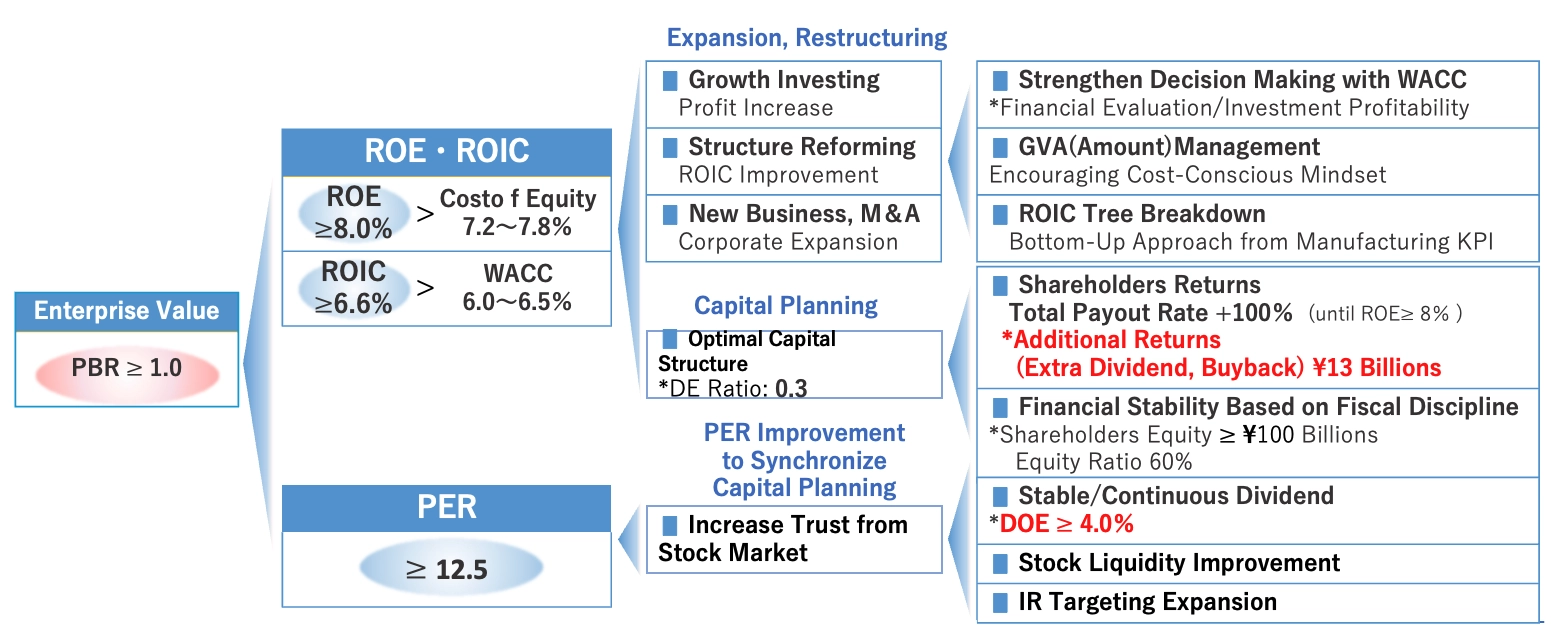

Accelerate High ROIC Business, Restructure Low-ROIC Business, Optimize Capital Structure, to Maximize Corporate Growth and Capital Efficiency

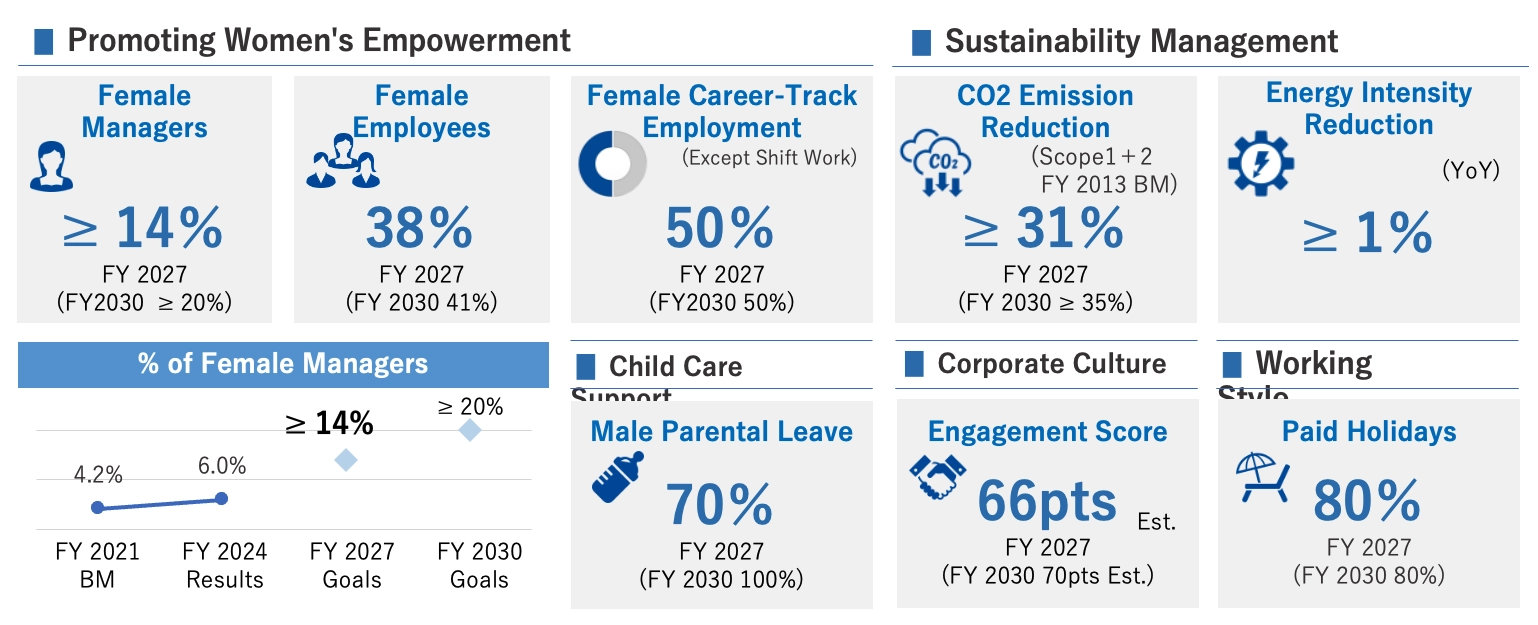

Non Financial Goal

Ensure CO2 Emission Reduction, Enhance Corporate Performance and Enterprise Value with Human Resource Empowerment

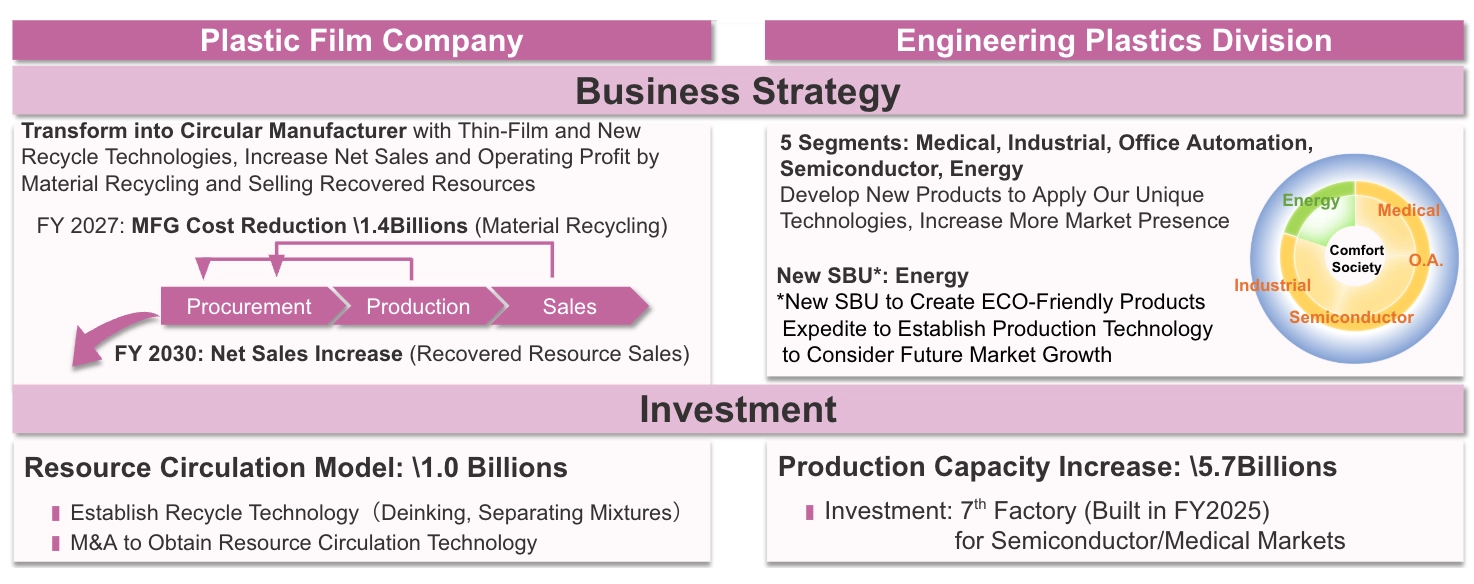

1. Functional Solutions

Plastic Film:Utilize Capabilities of

Recycle Technologies and Functional

Solutions, Expand Resource Circulation

Business Model around the World

Engineering Plastics:Increase Production

Capacity with Factory Expansion, Strengthen

Business in Semiconductor and Medial Markets

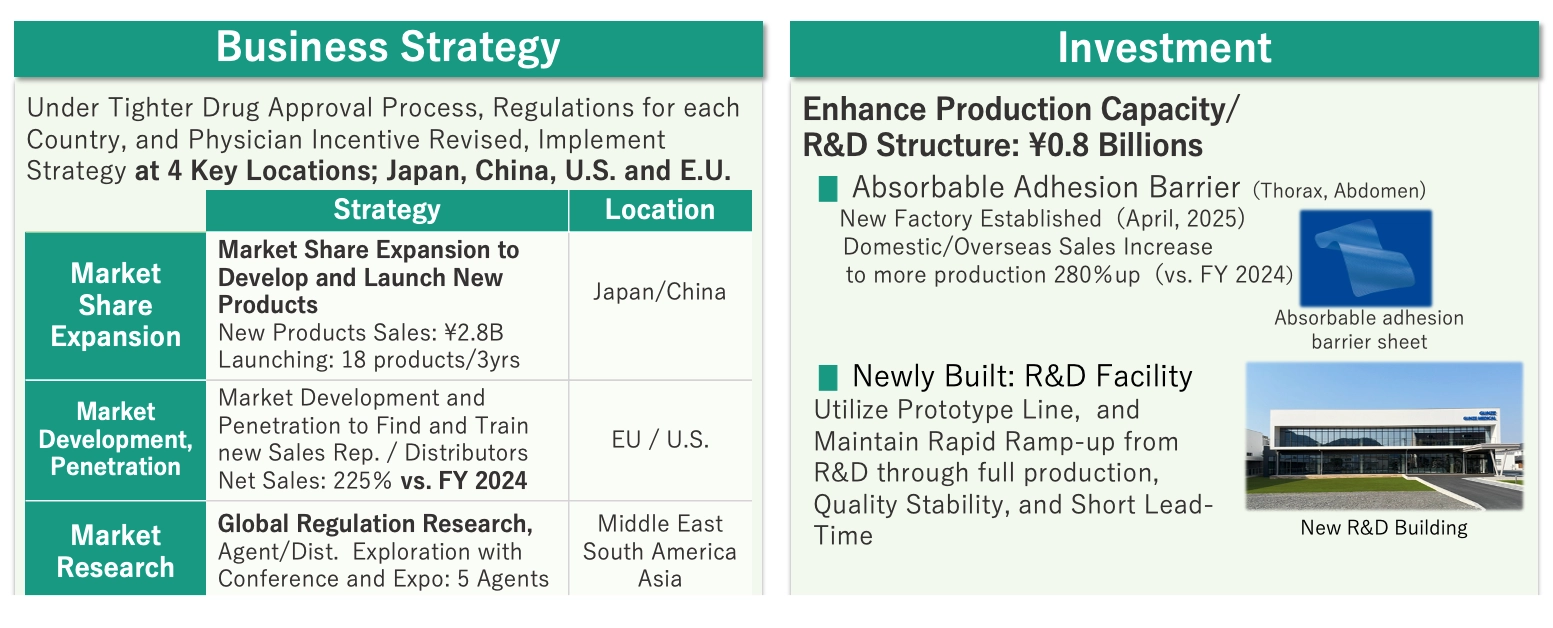

2. Medical Materials

Expand Market Share and Explore New Markets, Invent R&D and Manufacturing more, Success to Global Company

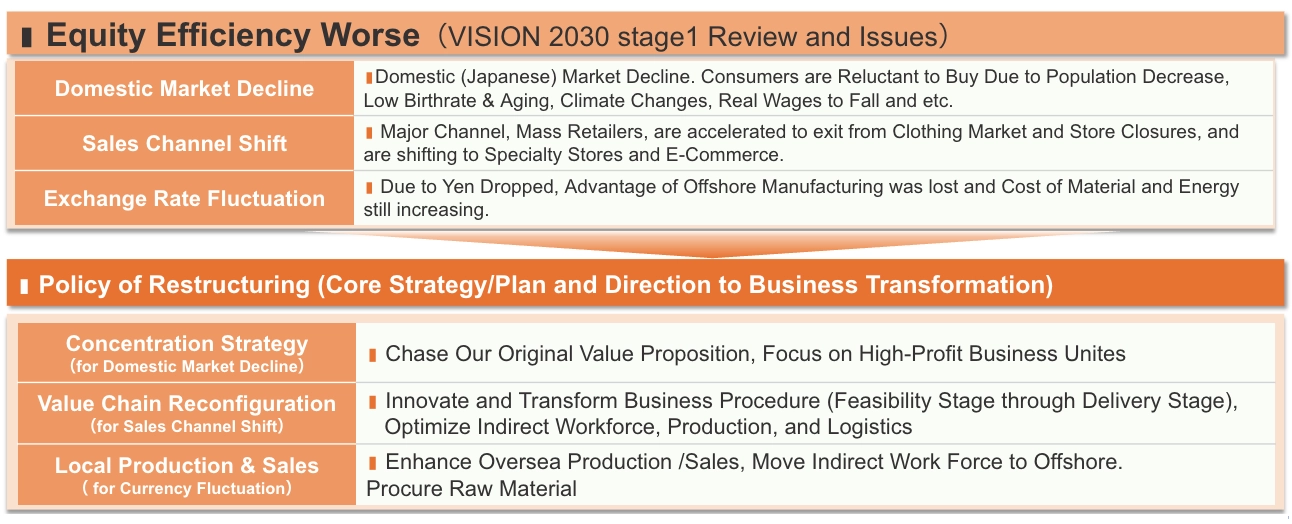

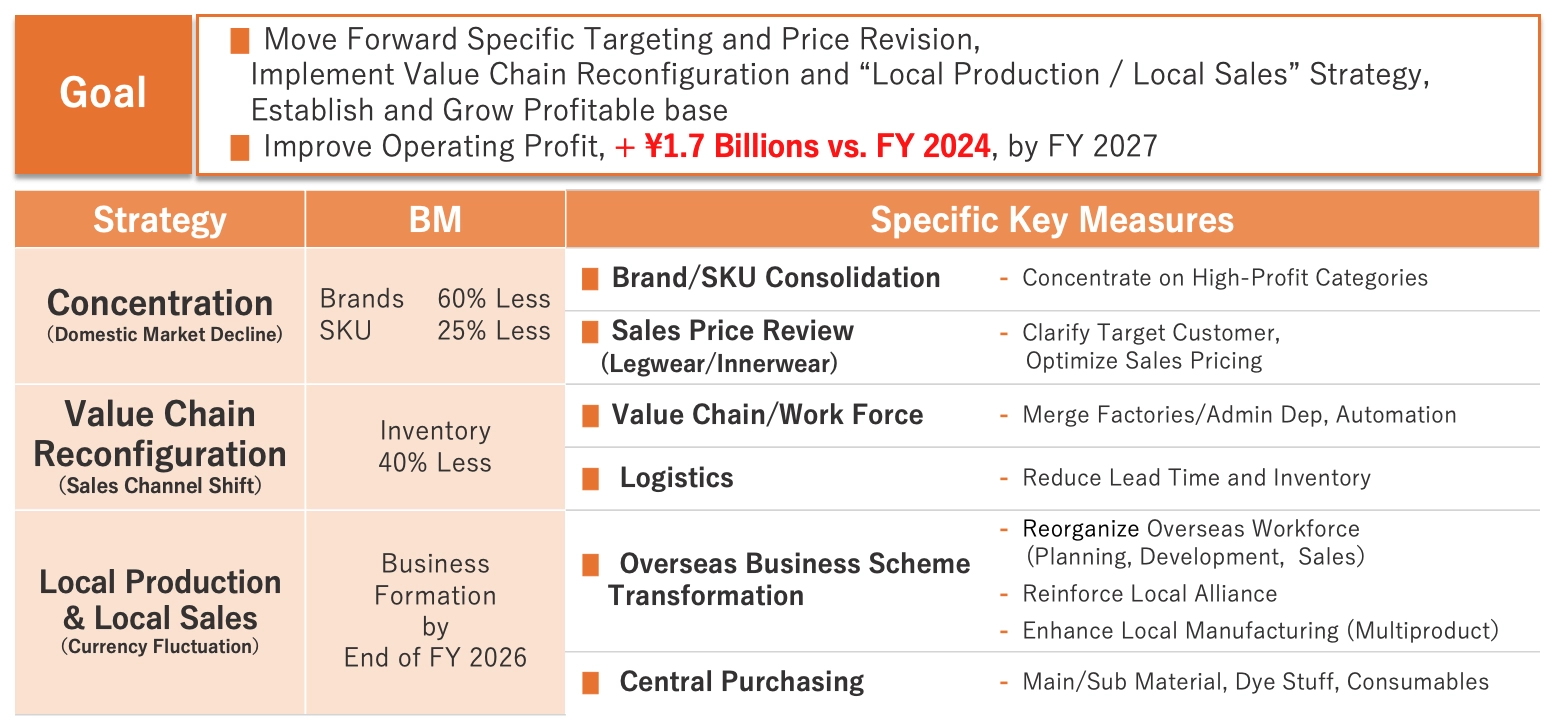

3.Apparel

Complete Restructuring Plan with no Exception Next 2 years (FY2025-2026), Execute Sustainable Business Turnaround to More Profitable

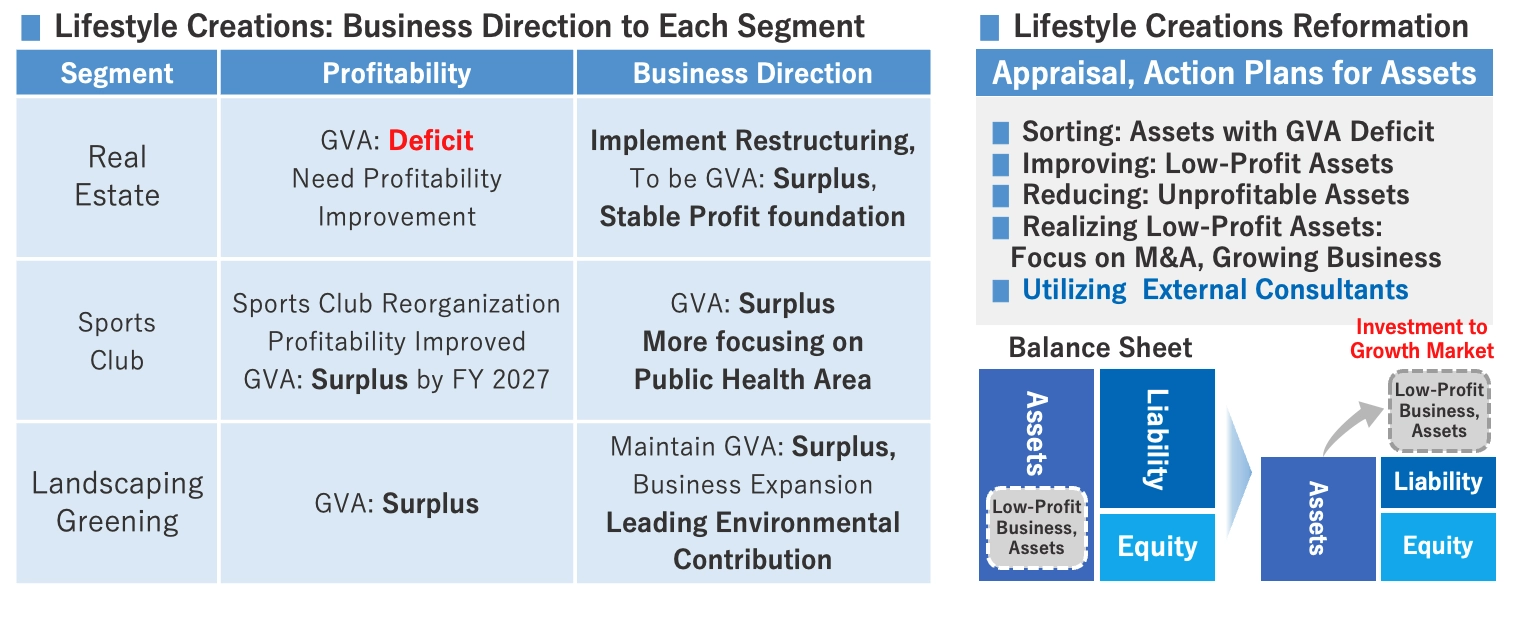

4.Lifestyle Creations

Appraise Profitability and Continuous Business Growth for Segments and Facilities, Implement Restructuring Plan to Facilities with GVA Deficit.

Summary

Implement Restructuring, Capital and PER Improvement Planning, Achieve PBR ≥ 1.0 to Enhance Enterprise Value

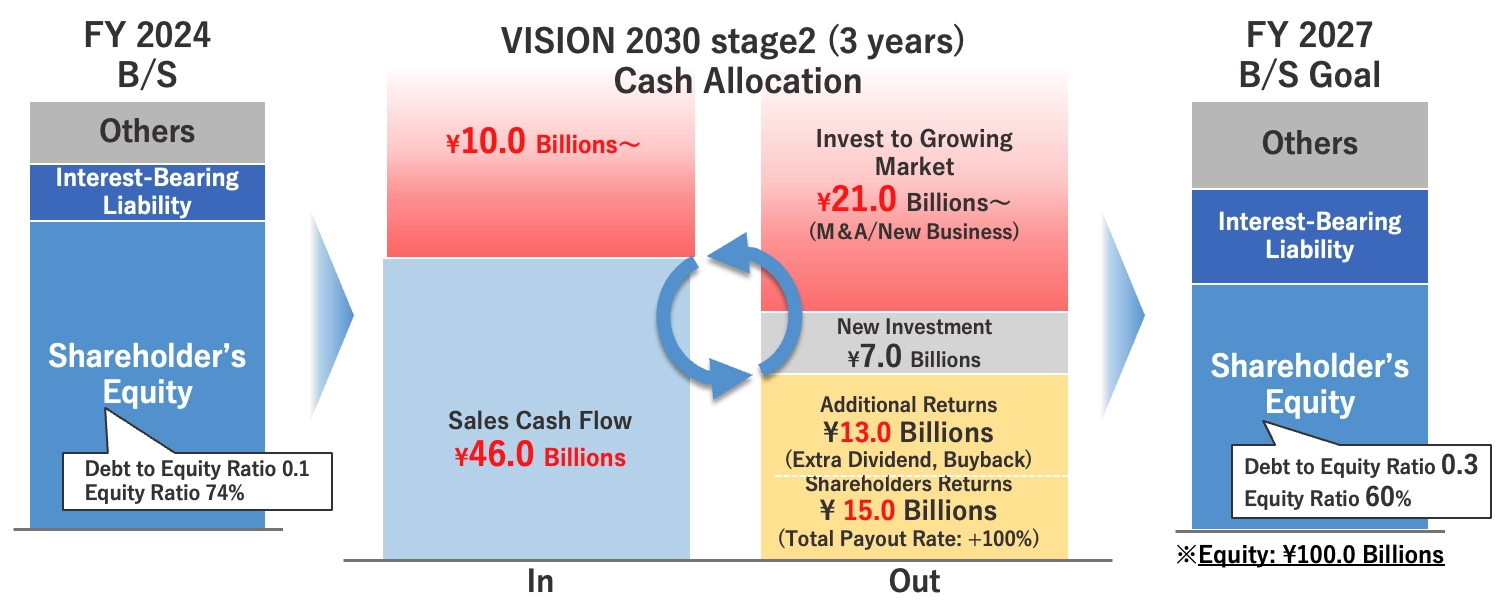

Capital Planning

By Resource Allocation to Growth Investing and Shareholder’s Return, and Proactive Leveraging, Optimize Equity to Maximize ROIC and Maintain Financial Stability

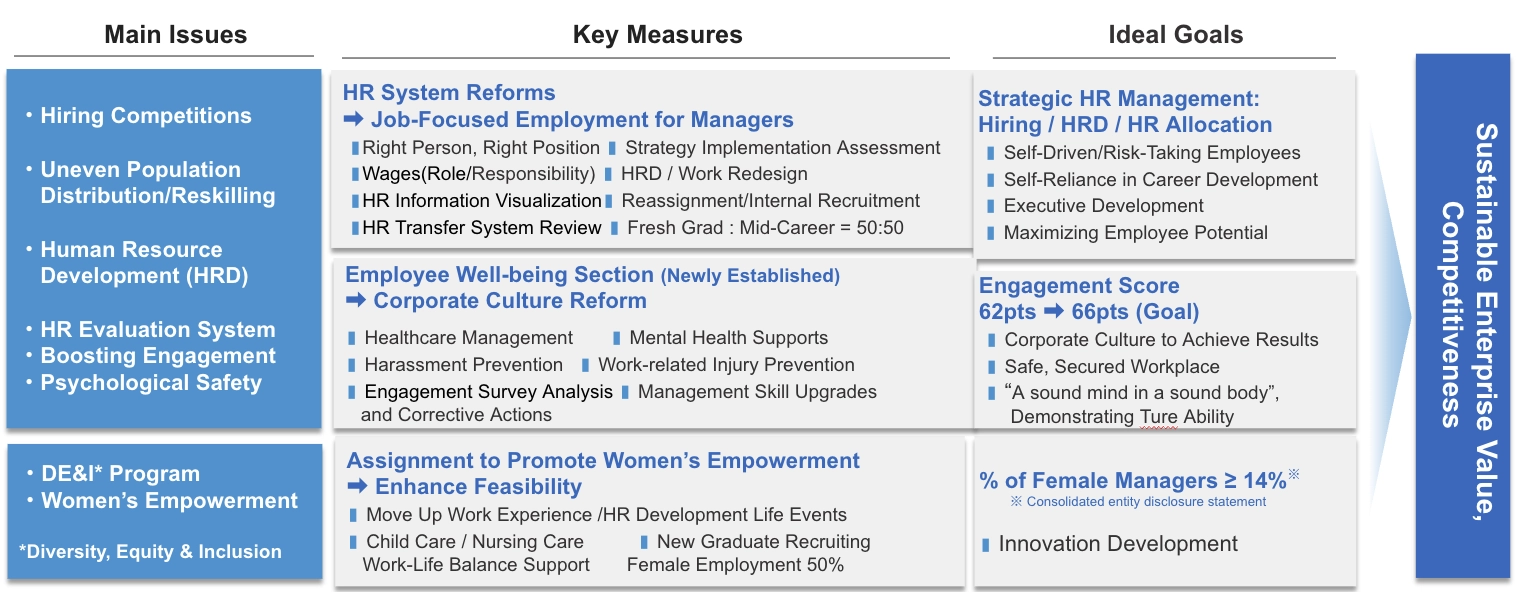

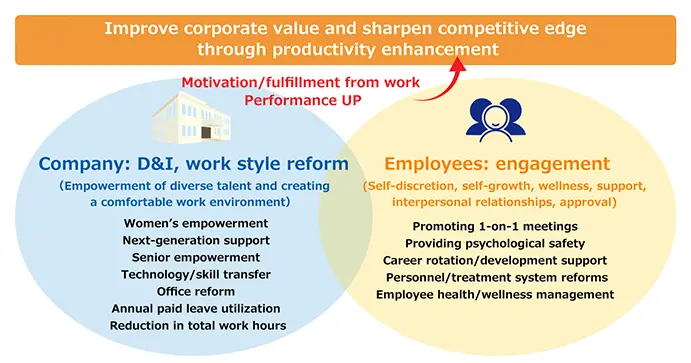

Build Human Resources and Corporate Culture to Implement Corporate Strategy For Sustainable Enterprise Value and Competitiveness Enhancement

Please see below for the details

Perception of Changes in the External Environment

| Changes | Impact | New Normal | GUNZE’s movements |

|---|---|---|---|

|

Changes in social

/ economic structures |

・Diversifying work

styles

・Expanding

healthcare /

nursing care

markets

・Growing EC market

|

<Living adapting to

the COVID-19

situation>

・Changing

consumer

purchasing

behavior

【Strong

sectors】 EC,

hygiene-related

business, home

meal

replacements,

etc. 【Sluggish

sectors】

Retail, travel,

eating out,

sports club,

etc.

・Accelerating

work style

reforms

【Offices】Downsizing

offices, office

relocations to

local regions

【Work

style】Teleworking

becoming the

normal

|

・Offering new

products /

services

responsive to

changes

・Promoting work

styles suitable

for the New

Normal

・Creating added

value through

digital

technology

→Taking on the

challenge of

growth strategy

and reinforcing

corporate

constitution

|

|

Advancing digital technology |

・Rapid growth

of businesses

that protect

against virus-

related

person-to-

person contact

・Accelerated

digital

transformation

|

||

|

Heightened environmental awareness |

・Increasing

company

commitment to

“net-zero GHG

emissions” by

2050

・SDGs

contribution

trending

・Strengthened

environmental

regulations

|

<Global trends>

・Accelerating

ESG investments

・Accelerating

efforts to

realize a

decarbonized

society

|

・Implementing

sustainable

management

→Enhancing

customer

satisfaction and

corporate value

|

In addition to the above, our business environment is becoming more severe and insecurity is on the rise with soaring oil / raw material costs and the depreciating yen

4 Pivotal Strategies

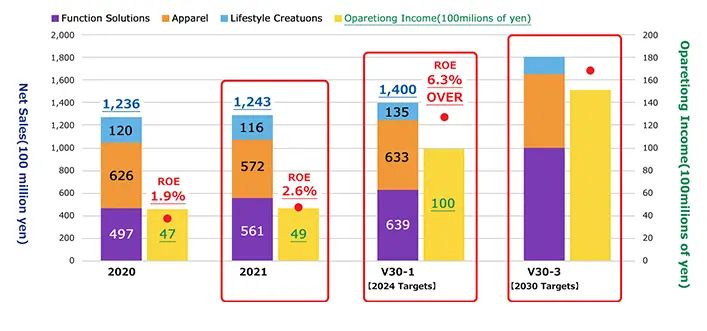

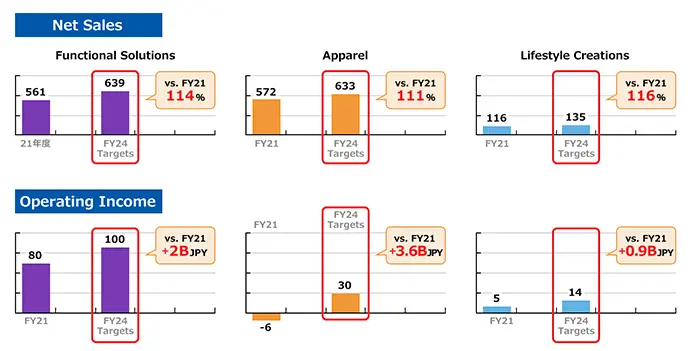

Management Goals (Financial Goals)

2024 targets

Net Sales(100 million yen):1,400 Opareting Income(100 millions of yen):100 ROE(%):6.3 over

※Plans by segment

Management Goals (Non-financial Goals)

| Category | Target indicators | 2024 targets | 2030 targets | |

|---|---|---|---|---|

| Environmental responsiveness | CO₂ emissions reduction rate (vs. FY2013, Scope 1+2) | 28% or higher | 35% or higher | |

| Per-unit energy consumption reduction rate (vs. previous year) | 1% / year or higher | |||

|

Corporate

constitution evolution |

Promotion of women’s empowerment | Ratio of women in managerial roles | 6% or higher | 20% or higher |

| Ratio of female employees in workforce | 35% | 41% | ||

| Ratio of women hired in main career track | 50% | 50% | ||

| Parenting support | Men’s paternity leave utilization rate | 50% | 70% | |

| Corporate culture creation | Engagement score | 70pt. (estimate) | 80pt. (estimate) | |

| Work style reform | Annual paid leave utilization rate | 75% | 100% | |

| Others |

Productivity

improvement rate (P

value*) *GUNZE’s own productivity metric over the previous year |

103% | 103% | |

① Creation of New Value

Build a corporate culture supportive of challenge and able to integrate the power and resources of the entire company

a. Creation of new businesses

and growing existing

businesses

a-1. Creation of new businesses ‐Promote innovation by diving deeper into core technologies and combining them effectively

・Commercialization of

functional films such as films

for next-generation lithium-ion

batteries

・Promote

partnering with startups and

M&A; developing platform for

new business creation

To

provide more security and

comfort and to benefit future

generations, we employ our

technology to help create a

sustainable society

a-2.Growing existing businesses

by expanding new fields /

domains

-People/earth-focused

products/services 【Security,

Reliability, Comfort】

b. Offering new

products/services designed with

enhanced sustainability in

mind

-People/earth-focused

products/services 【Security,

Reliability, Comfort】

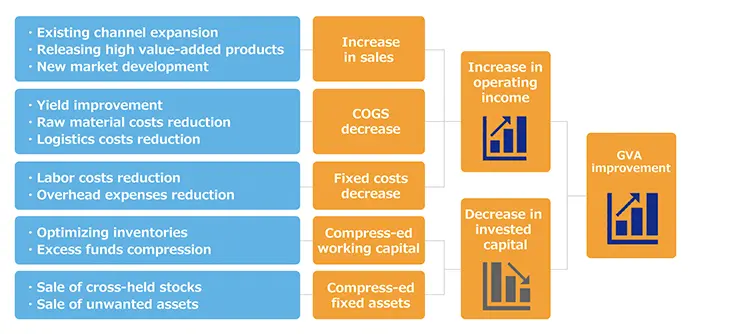

② Capital Cost-focused Management

Concentrate investments in

high-growth fields and

sustainability-focused

businesses Enhance capital

efficiency

by implementing

performance indicator tree for

GVA improvement

| Category | Indicator | 2021 results | 2024 targets |

|---|---|---|---|

| Company-wide | ROE | 2.6% | 6.3% or higher |

| GVA | -2,679 million yen | Positive company-wide GVA | |

| Divisions with positive GVA | ROIC | MBO based on ROIC | |

※ Divisions with negative GVA

value to exert efforts to

reach

positive GVA value

expeditiously

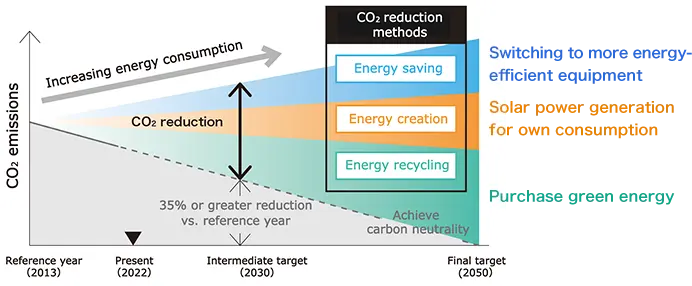

③ Environmentally Responsible Management

Reducing negative environmental impact through business activities

a. Significant promotion of energy saving, creation, and recycling activities

Reduce CO₂ emissions by 35% or more by 2030 (vs. 2013, Scope 1+2*)

*Creating Scope 3 reduction scenario by FY2022 end

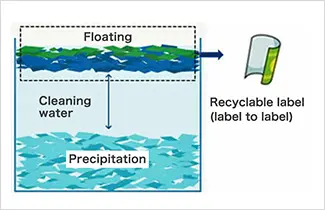

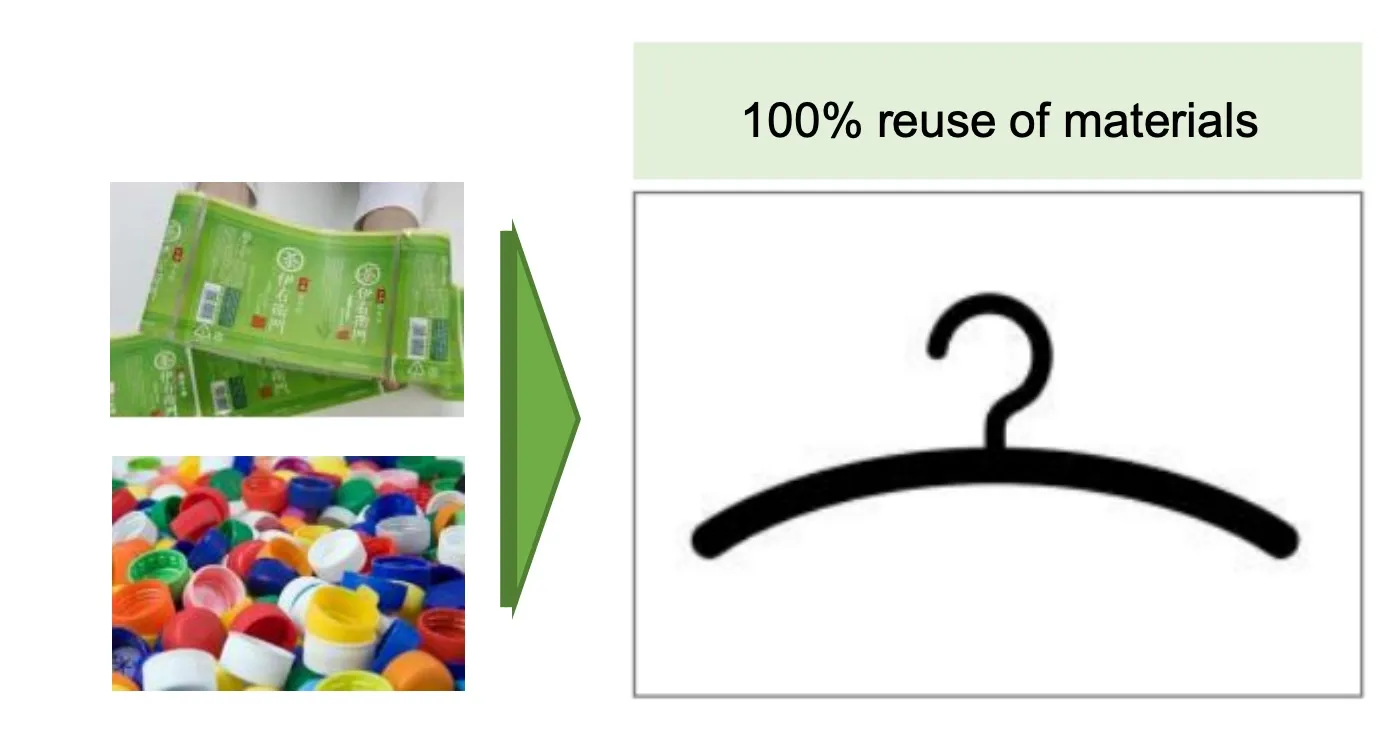

b. Resource circulation

Collaborative recycling promotion by Plastic Film and Apparel Divisions

c. Sustainable procurement

Promote purchase of

biomass/renewable materials

■Plan

to make 12 billion yen

environment-related investment

by 2030

|

Investment (100 millions of yen) |

Main investment plans | |

|---|---|---|

| V30-1 | 86 |

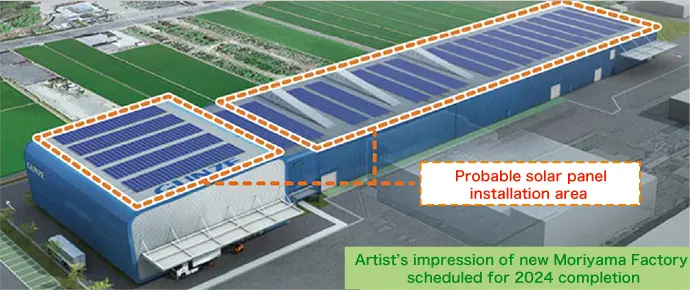

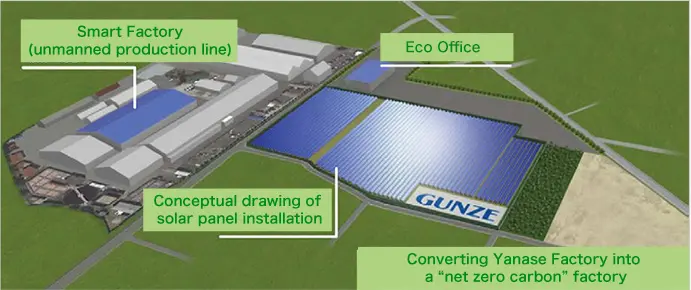

Circular Factory

(Moriyama) “Net Zero Carbon” Factory (Yanase) Enhanced-efficiency equipment Solar power generation system Waste solvent recycling equipment |

| V30-2 | 25 | |

| V30-3 | 9 | |

| Total | 120 | |

Environmentally responsible model factories

Circular Factory

a. Petrochemical raw

material use reduction

Thinner

film design, increasing

bio-based raw materials

use

b.

Establishing a resource

circulation system

Recycling-oriented

product development,

establishing technology for

raw material recycling

c.

Efficient resource

utilization

Recovering

solid plastic waste for

reuse to realize “zero

emissions”

Zero emissions

“Net Zero Carbon” Factory

a. Energy efficiency

improvement Realtime

visualization

of energy usage, updating

equipment to increase energy

efficiency

b.

Fossil fuel usage reduction

Switching to full

electrification

c.

Solar panel installation and

greening

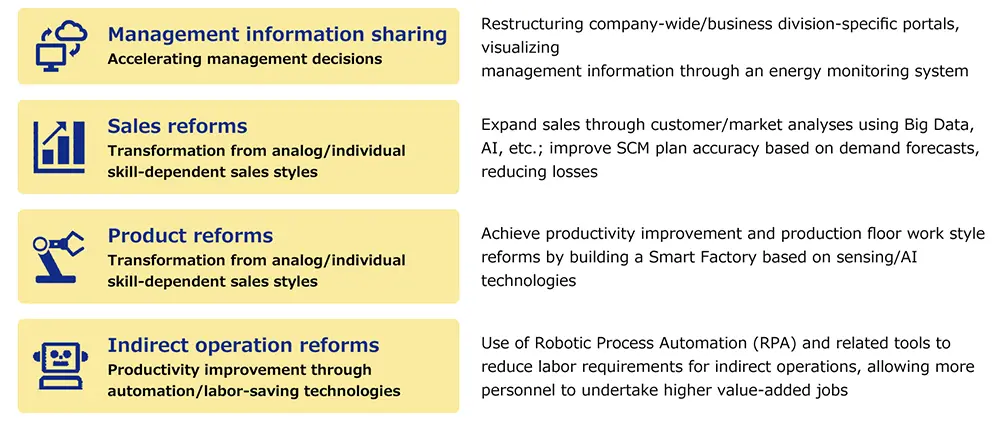

④ Evolution of Corporate Constitution

Nurture an organizational culture supporting diverse talent to attain fulfillment from work, establishing GUNZE as a healthy and visionary company that society can rely on

Create new value through business processes transformed through digital technology

Investment Strategy

Strive to sustainably improve corporate value and coexist well with our planet through growth and environment-related investments

| Focus areas | Main investment plans |

Investment amount (2022~2024) |

|---|---|---|

|

Investing in new

fields / equipment essential for sustainable growth |

・Investing in new

equipment and

strengthening

production

capacities mainly

for plastic films,

engineering

plastics, and

medical materials ・Establishing a solid foundation allowing apparel to shift to DTC business model ・Renovation of “Gunze Town Center TSUKASHiN” |

11.4 billion yen |

| Environment-related investment |

・Circular Factory

(Plastic Film,

Moriyama Factory) ・Net Zero Carbon Factory(Innerwear, Yanase Factory) |

8.6 billion yen |

| Re-development of business sites and others | Building extension / reconstruction, equipment relocation, etc., accompanying environment- related investments | 8.8 billion yen |

| Updating/improving efficiency in existing equipment/facilities | - | 4.3 billion yen |

・Funding for M&A

investments to be flexibly

supplied as additional budget

・10

billion yen spend over 3 years

planned for R&D (previous 3

years: 8.3 billion yen)

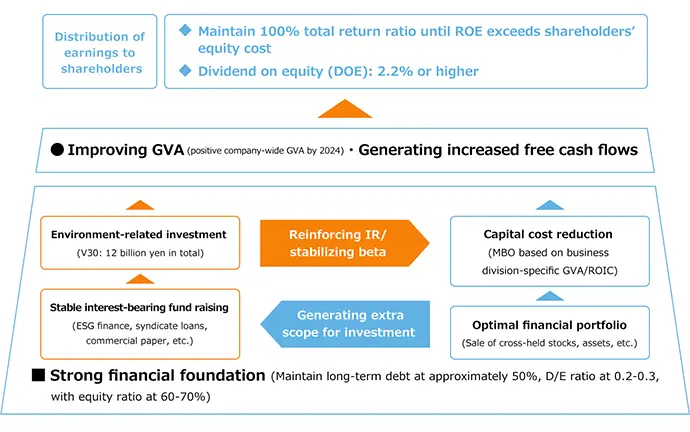

Financial Strategy

Achieve environment-related investments and capital cost reduction while maintaining a solid financial foundation, improving GVA and generating increased free cash flows

Please see below for the details